Section 179 Assets

For tax years beginning after 2017 the tcja increased the maximum section 179 expense deduction from 500 000 to 1 million.

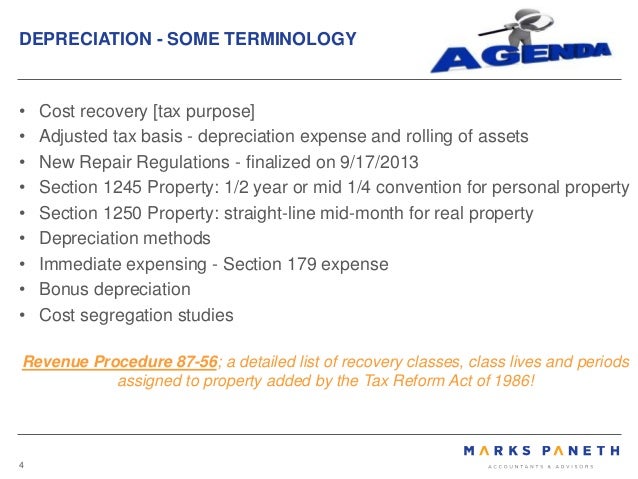

Section 179 assets. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2 550 000. For purposes of this section the term section 179 property means any tangible property to which section 168 applies which is section 1245 property as defined in section 1245 a 3 and which is acquired by purchase for use in the active conduct of a trade or business. This allows businesses to.

The phase out limit increased from 2 million to 2 5 million. That s why almost all types of business equipment that your company buys or finances will qualify for the section 179 deduction. Essentially section 179 of the irs tax code allows businesses to deduct the full purchase price of qualifying equipment and or software purchased or financed during the tax year.

Section 179 of the irc allows businesses to take an immediate deduction for business expenses related to depreciable assets such as equipment vehicles and software. Tax code allowing for businesses to deduct property cost when eligible. It s very likely that your business will purchase many of these goods during the year and will do so again and again.

Section 179 refers to a section of the u s. Section 179 was designed with businesses in mind. The new extended dollar limitation under sec.

Section 179 deductions allow taxpayers to deduct the cost of specific properties as expenses when those properties are used as a service. Such term shall not include any property described in section 50 b and shall not include air conditioning or heating units. Section 179 allows taxpayers to deduct the cost of certain property as an expense when the property is placed in service.

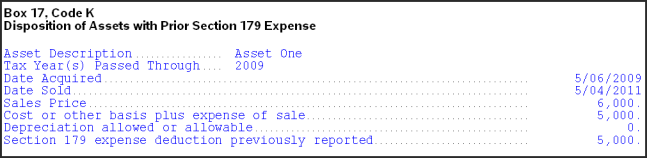

The 1120s schedule k 1 box 17 code k instructions for dispositions of property with section 179 deductions state the corporation reports the shareholder s pro rata share of gain or loss on the sale exchange or other disposition of property for which a section 179 expense deduction was passed through to shareholders. 179 allows a taxpayer to elect to expense up to 250 000 of the cost of qualifying property placed in service during a tax year. That means that if you buy or lease a piece of qualifying equipment you can deduct the full purchase price from your gross income.

.jpg)