Section 179 Depreciation Recapture

1245 to the extent of any gain realized on the disposition at the owner level.

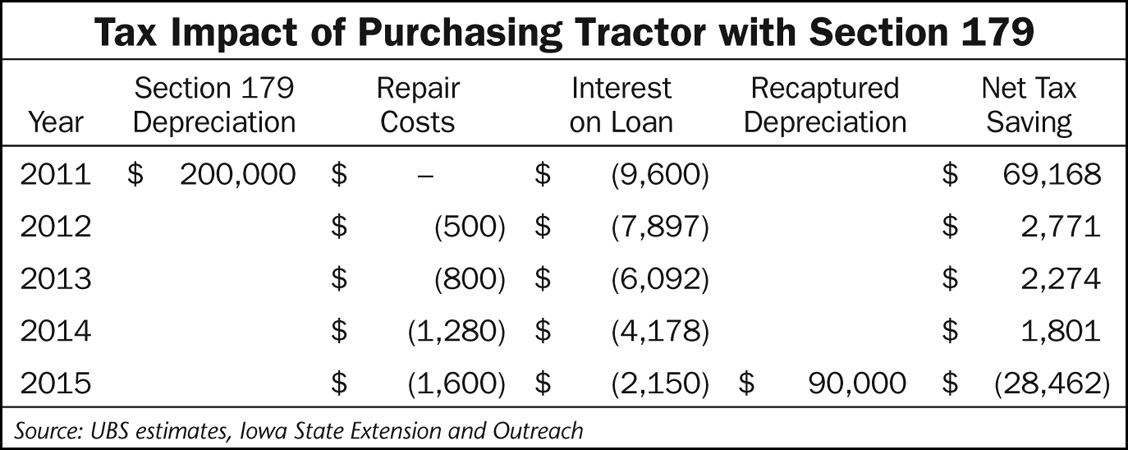

Section 179 depreciation recapture. You can depreciate tangible property but not land. Alternatively you can depreciate the acquisition cost over a 5 year recovery period in the year you place the computer in service if you don t elect to expense any of the cost under section 179 the computer isn t eligible for the 100 special depreciation allowance in the year you place the computer in service or you decide to elect out of any special depreciation allowance for the class of property that includes computers. Since that s less than.

Return of partnership income if a passthrough entity disposed of sec. Figure the depreciation that would have been allowable on the section 179 deduction you claimed. Figure the depreciation that would have been allowable on the section 179 deduction you claimed.

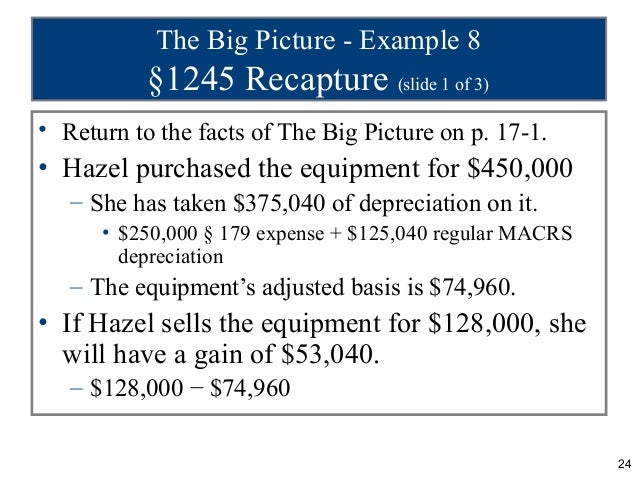

To figure the amount to recapture take the following steps. Depreciation recapture applies to the lesser of the gain or your depreciation deductions. Tax depreciation section 179 deduction and macrs depreciation is the amount you can deduct annually to recover the cost or other basis of business property.

Income tax return for an s corporation or form 1065 u s. This must be for property with a useful life of more than one year. 179 property during the tax year the amount of the sec.

If you took a section 179 deduction for depreciation you must recapture depreciation in any year during the property s recovery period where your business usage of the asset drops below 50 percent. Subtract the depreciation figured in 1 from the section 179 deduction you claimed. Subtract the depreciation figured in 1 from the section 179 deduction you claimed.

The difference between the section 179 deduction and the used up portion of macrs depreciation is called a section 179 recapture and must be reported as income. 179 expense previously passed through to its owners on a schedule k 1 is treated as depreciation and must be recaptured under sec. Begin with the year you placed the property in service and include the year of recapture.