Section 179 Expense 2014

Any cost so treated shall be allowed as a deduction for the taxable year in which the section 179 property is placed in service.

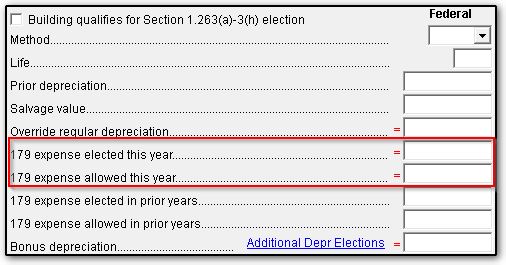

Section 179 expense 2014. A 2013 deduction attributable to qualified real property which is disallowed under the trade or. If you acquire and place in service more than one item of qualifying property during the year you can allocate the section 179 expense deduction among the items in any way as long as the total deduction is not more than 25 000. First special 50 percent first year bonus depreciation available before 2014 for certain qualified property is no longer available for most types of property.

Section 179 in 2013 section 179 had a limit of 500 000 in 2013. Section 179 had a limit of 500 000 in 2014. Section 179 of the united states internal revenue code 26 u s c.

Small and medium businesses benefit the most. Section 179 allows taxpayers to deduct the cost of certain property as an expense when the property is placed in service. The section 179 deduction is currently 500 000 for 2014.

Plus the 50 bonus depreciation has returned as well making section 179 a fantastic deal for 2014. Qualified section 179 real property the maximum section 179 expense deduction that may be expensed for qualified section 179 real property is 250 000 of the total cost of all section 179 property placed in service in 2014. The phase out limit increased from 2 million to 2 5 million.

For tax years beginning after 2017 the tcja increased the maximum section 179 expense deduction from 500 000 to 1 million. A treatment as expenses a taxpayer may elect to treat the cost of any section 179 property as an expense which is not chargeable to capital account. New bonus depreciation section 179 expensing rules for 2014 for 2014 two highly favorable federal income tax provisions for business owners have been curtailed or eliminated.

Click the link above for more information and a 2014 section 179 calculator.