Internal Revenue Code Section 351

Code unannotated title 26.

Internal revenue code section 351. 351 u s. Internal revenue code 351 findlaw. Corporate distributions and adjustments.

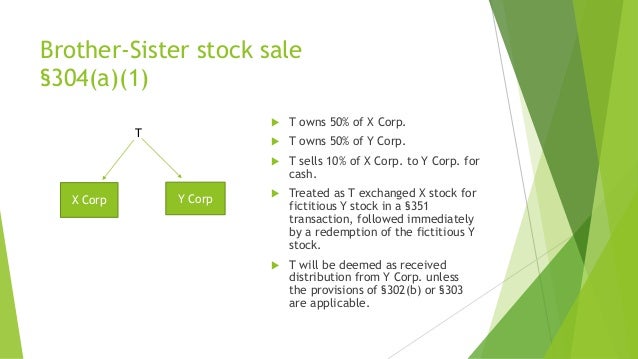

Section 351 a provides that no gain or loss will be recognized if property is transferred to a corporation by one or more persons solely in exchange for stock in such corporation and immediately after the exchange such person or persons are in control as defined in 368 c of the corporation. Internal revenue code section 351. Internal revenue code 351.

Transfer to corporation controlled by transferor. Normal taxes and surtaxes. Transfer to corporation controlled by transferor.

Transfer to corporation controlled by transferor. No gain or loss shall be recognized if property is transferred to a corporation by one or more persons solely in exchange for stock in such corporation and immediately after the exchange such person or persons are in control as defined in section 368 c of the corporation. No gain or loss shall be recognized if property is transferred to a corporation by one or more persons solely in exchange for stock in such corporation and immediately after the exchange such person or persons are in control as defined in section 368 c of the corporation.