Delaware Franchise Tax Section

Corporate tax refund returns 302.

Delaware franchise tax section. 302 739 3073 option 3 or click below. Taxes are assessed if the corporation is active in the records of the division of corporations anytime during january 1st through december 31st of the current tax year. Business license assistance 302 577 8778.

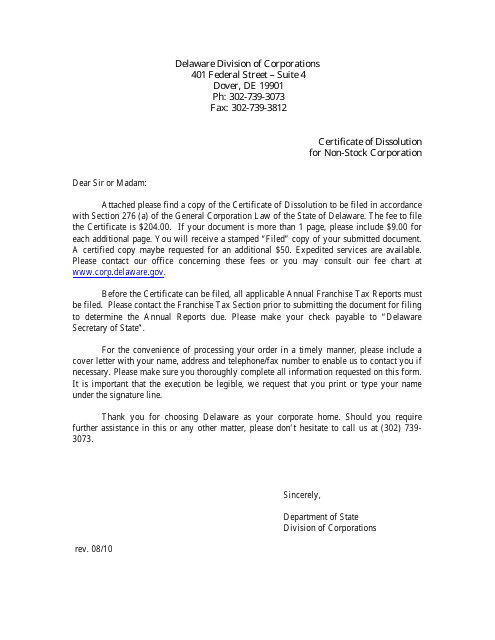

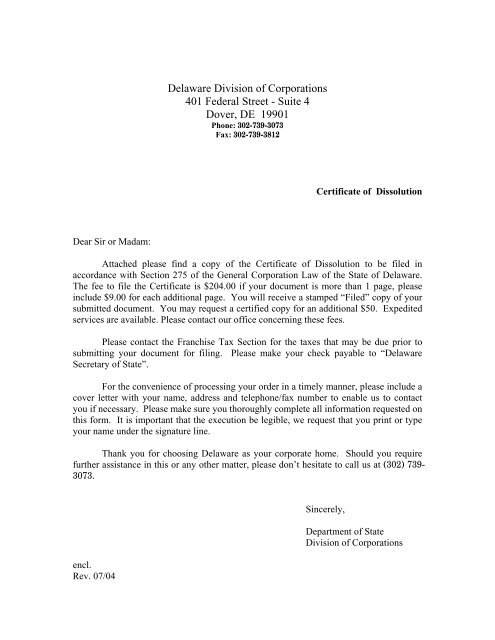

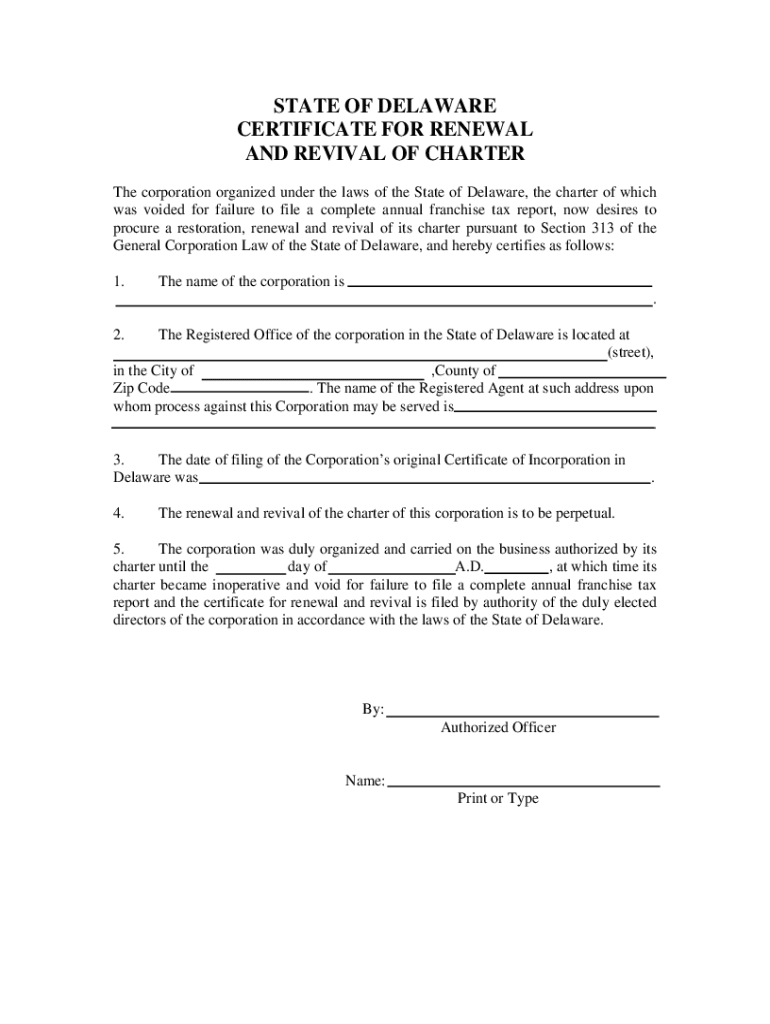

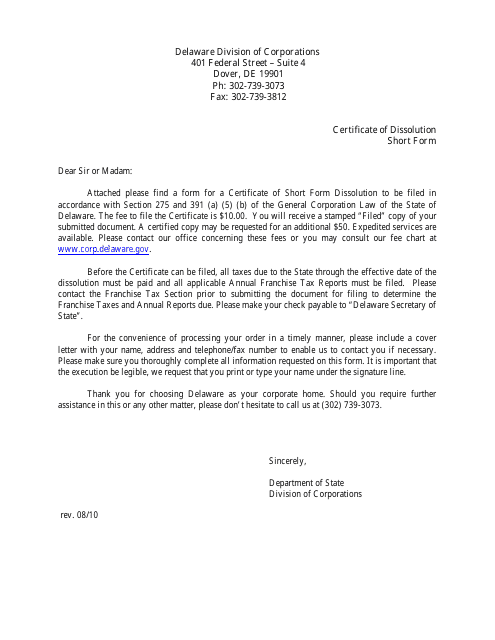

It is simply required by the state of delaware to maintain the good standing status of your company. Any delaware corporation that is ending its existence or reinstating their status to good standing is required by law to file an annual report and pay any and all tax due. The bank franchise tax is imposed on banking organizations.

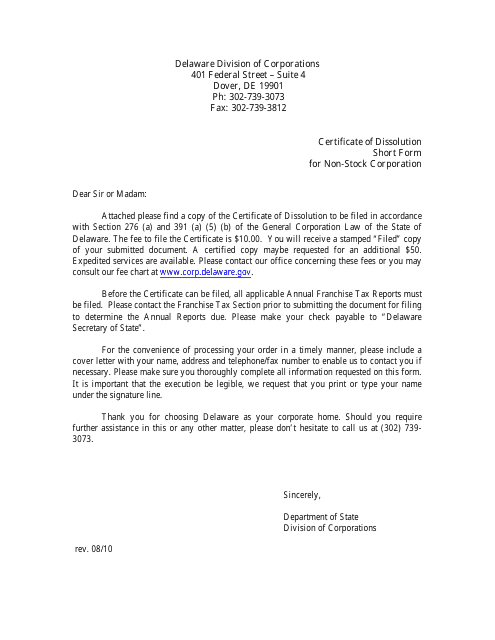

Corporate franchise tax see division of corporations dosdoc ftax delaware gov. Please contact the franchise tax section at 302 739 3073 and select option 3 and option 1 or by email at dosdoc ftax delaware gov before submitting your renewal merger dissolution conversion or any other document filing that will end the existence or renew the status of your delaware corporation. Why incorporate in delaware.

The tax has no bearing on income or company activity. In the event of neglect refusal or failure on the part of any corporation to file a complete annual franchise tax report with the secretary of state on or before march 1 the corporation shall pay the sum of 200 to be recovered by adding that amount to the franchise tax as herein determined and fixed and such additional sum shall become a part of the franchise tax as so determined and fixed and shall be collected in the same manner and subject to the same penalties. Corporate tax auditors 302 577 8783.

More than one million business entities take advantage of delaware s complete package of incorporation services including modern and flexible corporate laws our highly respected judiciary and legal community a business friendly government and the customer service oriented staff of the division of corporations. The minimum tax is currently 175 00 using the authorized shares method and the minimum tax using the assumed par value capital method is 400 00 with a maximum tax of 200 000 00 for both methods unless it has been identified as a large corporate filer then their tax will be 250 000 00. Title 5 delaware code chapter 1 section 101 7 defines banking organizations.

You can also stay current on delaware corporate law. Franchise tax is the fee imposed by the state of delaware for the right or privilege to own a delaware company. The minimum tax is 175 00 for corporations using the authorized shares method and a minimum tax of 400 00 for corporations using the assumed par value capital method.