Can You Take Section 179 On Leasehold Improvements

Section 179 historically was only applicable to tangible personal property not real property.

Can you take section 179 on leasehold improvements. Roofs heating ventilation and air conditioning property fire protection and alarm systems and security systems as long as the improvements are placed in service after the date the building was first placed in service. Qip qualified leasehold improvements qualified restaurant property and qualified retail improvement property may be eligible for section 179 expensing subject to certain limitations. The new roof will be capitalized on your depreciation schedule and expensed under section 179 provision and the old roof is removed.

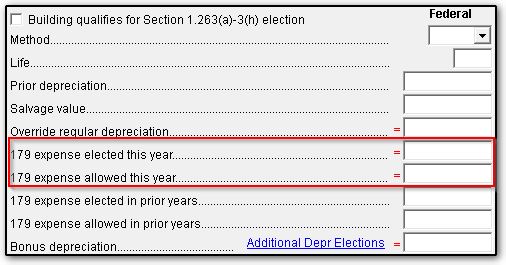

In addition if these improvements meet the requirements to be qualified real property under irc section 179 and the other requirements of section 179 are met they may be eligible to be immediately expensed. You can elect the section 179 deduction instead of recovering the cost by taking depreciation deductions. Expensing under section 179 you can generally expense qualified leasehold improvements up to 500 000 adjusted annually for inflation under section 179 as opposed to depreciating them.

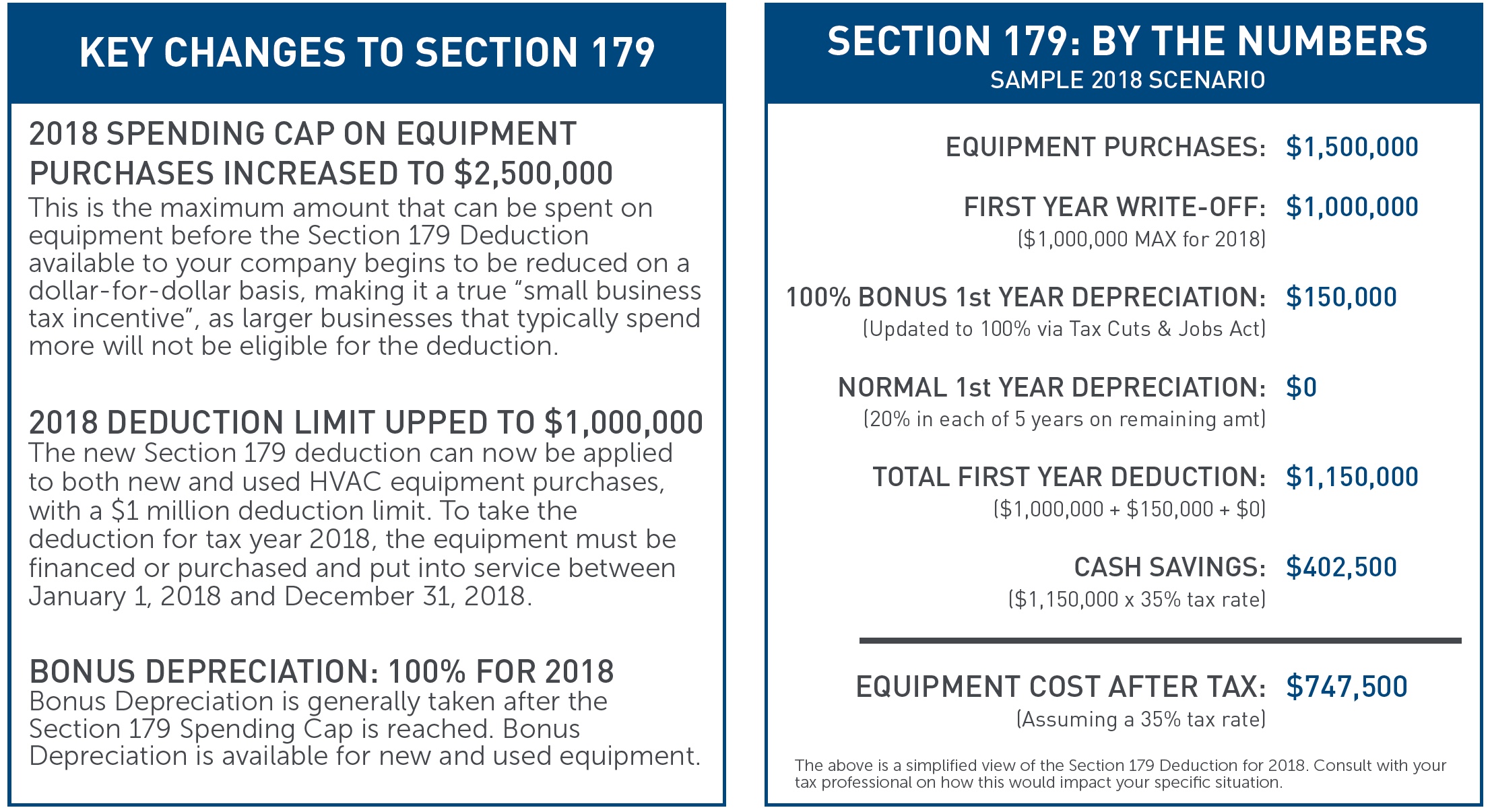

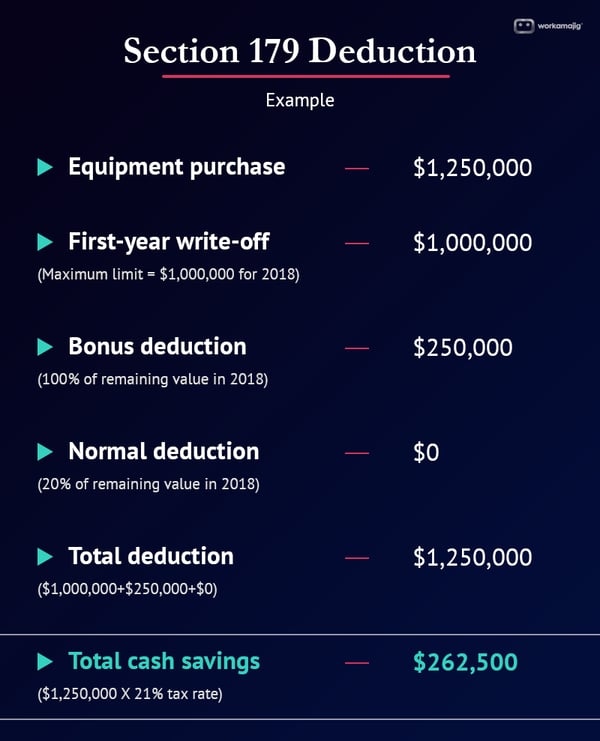

The new law increased the maximum deduction from 500 000 to 1 million. You can elect to recover all or part of the cost of certain qualifying property up to a limit by deducting it in the year you place the property in service. One of the major changes to section 179 expensing is the ability to fully deduct qualified leasehold improvements.

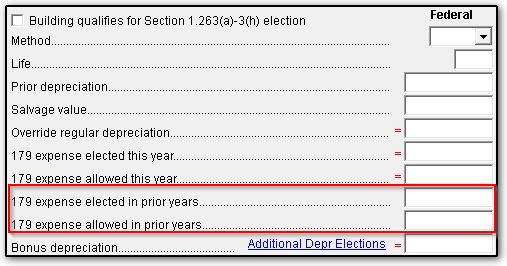

Improvement expenditures may be eligible for immediate expensing through section 179 depreciation. However section 179 begins to phase out when you place in service assets valued in excess of 2 000 000 in a single tax year. The rules for each category of qualified improvements have changed several times over the last decade making it difficult for tax professionals to keep track.

Qualified leasehold improvements can be expensed up to 250 000 for tax years beginning in 2010 and 2011. It also increased the phase out threshold from 2 million to 2 5 million. Once this is corrected lessees and building owners who improve qualifying business property will reap federal tax benefits of shorter depreciable lives increase bonus depreciation deductions and section 179 expensing.

What if you spent 750 000 on leasehold improvements this year for one of your retail strip plazas. This is the section 179 deduction. Who should make improvements landlord or tenant.