Section 1245 Assets

Property used in a trade or business the internal revenue code includes multiple classifications for property.

Section 1245 assets. Section 1245 property defined. The program recaptures all depreciation for section 1245 personal property based on macrs methods 34 69 88 and acrs methods 30 63 entered in method when entering the sale or disposition through thedisposition screen the depreciation allowed entry code 30 should include any prior year and current year depreciation for the asset. Depreciation taken on other property or taken by other taxpayers.

According to the internal revenue service irs section 1245 property is defined as intangible or tangible personal property that could be or is subject to depreciation or amortization excluding. 1 the term property described in section 1245 a 3 b means tangible property of the requisite depreciable character other than personal property and other than a building and its structural components but only if there are adjustments reflected in the adjusted basis of the property within the meaning of paragraph a 2 of 1 1245 2 for a period during which such property or other property. Prior to amendment introductory provisions read as follows.

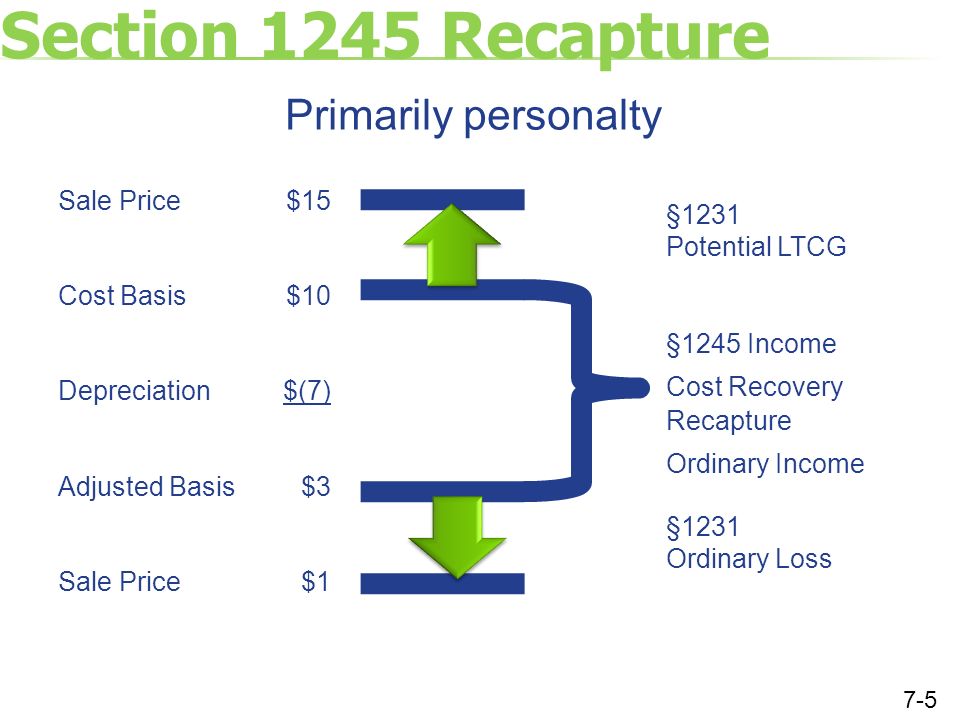

Gain treated as ordinary income. 1245 property is all depreciable personal property and some other real depreciable property but not buildings or. 1231 property are assets used in your trade or business held by you for more than one year.

Other tangible property except buildings and their structural components used as any of the following. For purposes of this section the term section 1245 property means any property which is or has been property of a character subject to the allowance for depreciation provided in section 167 or subject to the allowance of amortization provided in and is either. This could be your carpet.

1250 property is depreciable property that is not 1245. Buildings and structural components. 1231 1245 and 1250.

Facility for bulk storage of fungible commodities. An integral part of manufacturing production or extraction or of furnishing transportation communications. Section 1245 a section of the irs tax code indicating that any depreciable property that is sold for more than the depreciated value qualifies for capital gains taxation rather than income taxation.

:max_bytes(150000):strip_icc()/architecture-building-urban-facade-property-professional-1364228-pxhere.com-cfab579cc3b64694913efdb2ea4d85c0.jpg)