Internal Revenue Code Section 213

Amendment by section 474 r 9 of pub.

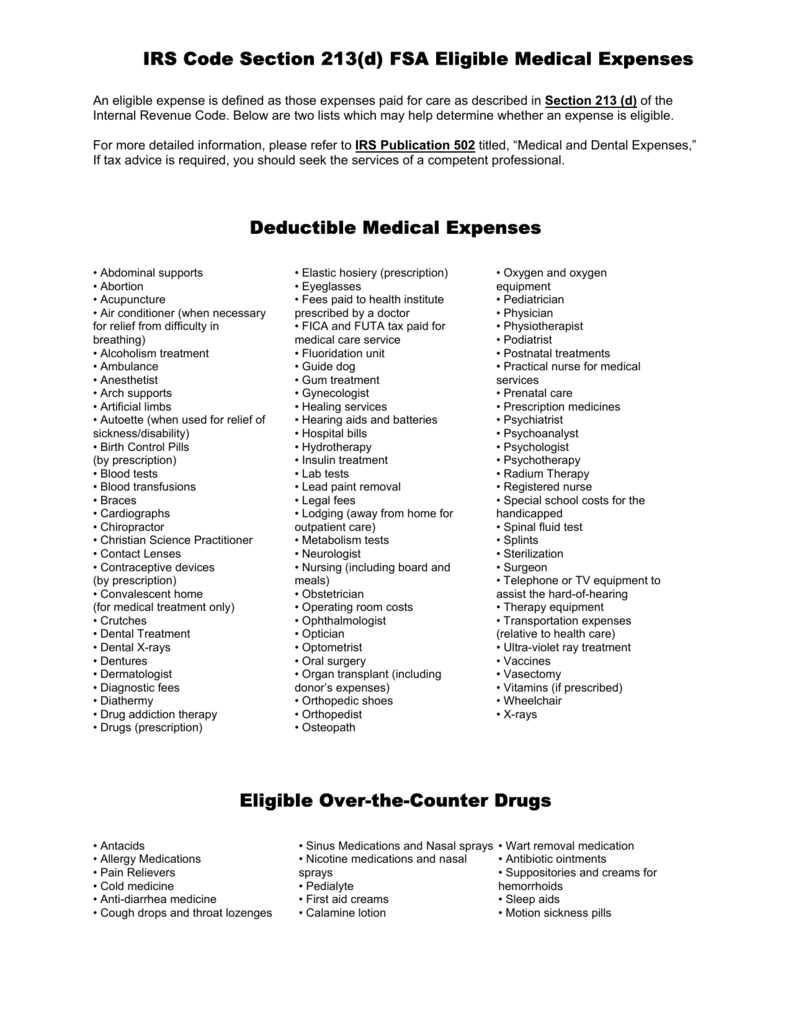

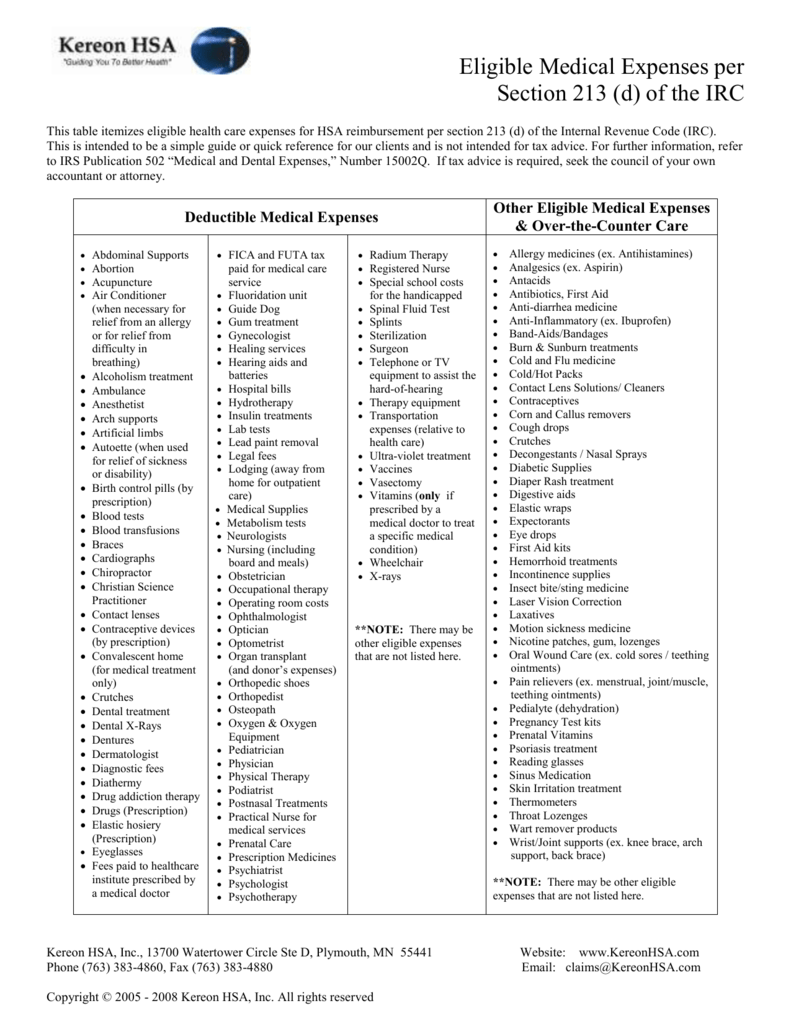

Internal revenue code section 213. An eligible expense is defined as those expenses paid for care as described in section 213 d of the internal revenue code. 98 369 set out as a note under section 21 of this title. We welcome your comments about this publication and your suggestions for future editions.

For more detailed information please refer to irs publication 502. Below are two lists which may help determine whether an expense is eligible. The amendments made by this section amending this section and sections 72 79 401 and 405 of this title shall apply to taxable years beginning after december 31 1966.

There shall be allowed as a deduction the expenses paid during the taxable year not compensated for by insurance or otherwise for medical care of the taxpayer his spouse or a dependent as defined in section 152 determined without regard to. Table of contents retrieve by section number. Federal tax law begins with the internal revenue code irc enacted by congress in title 26 of the united states code 26 u s c.

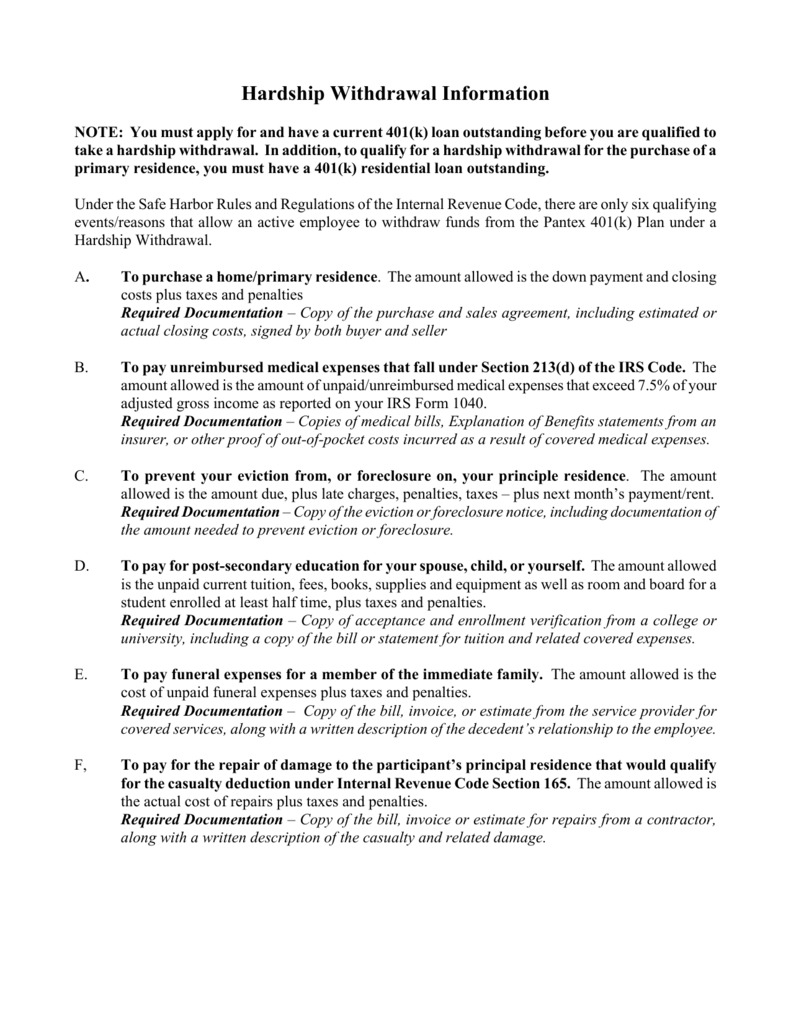

Below are two lists which may help determine whether an expense is eligible. Internal revenue code section 213 d medical dental etc expenses. Section 213 of the internal revenue code irc allows a deduction for expenses paid during the taxable year not compensated for by insurance or otherwise for medical care of the taxpayer spouse or dependent to the extent the expenses exceed 7 5 of adjusted gross income.

Nw ir 6526 washington dc 20224. You can send us comments through irs gov formcomments or you can write to. Internal revenue service tax forms and publications 1111 constitution ave.

Irs code section 213 d eligible medical expenses an eligible expense is defined as those expenses paid for care as described in section 213 d of the internal revenue code. For taxable years beginning before january 1 1967 whether or not the 3 percent or 1 percent limitation applies the total medical expenses deductible under section 213 are subject to the limitations described in section 213 c and paragraph c of this section and where applicable to the limitations described in section 213 g and 1 213 2. Section 106 e of pub.