Section 382 Of The Internal Revenue Code

As a summary c corporations are those under us law that are taxed separately from their owners.

Section 382 of the internal revenue code. The internal revenue code of 1986 as amended the code. The tax benefits that could be limited include net operating losses nols net capital losses nols. Any regulations prescribed under section 382 of the internal revenue code of 1986 as added by subsection a which have the effect of treating a group of shareholders as a separate 5 percent shareholder by reason of a public offering shall not apply to any public offering before january 1 1989 for the benefit of institutions described in section 591 of such code.

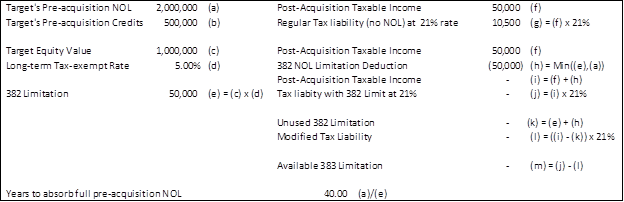

Proposed amendments to the regulations. This notice provides guidance under 382 of the internal revenue code for measuring owner shifts of loss corporations that have more than one class of stock outstanding and in particular regarding the effect of fluctuations in the value of one class of stock relative to another class of stock fluctuations in value. A loss corporation is a firm that can use tax attributes such as net operating loss nol to deduct their taxable income.

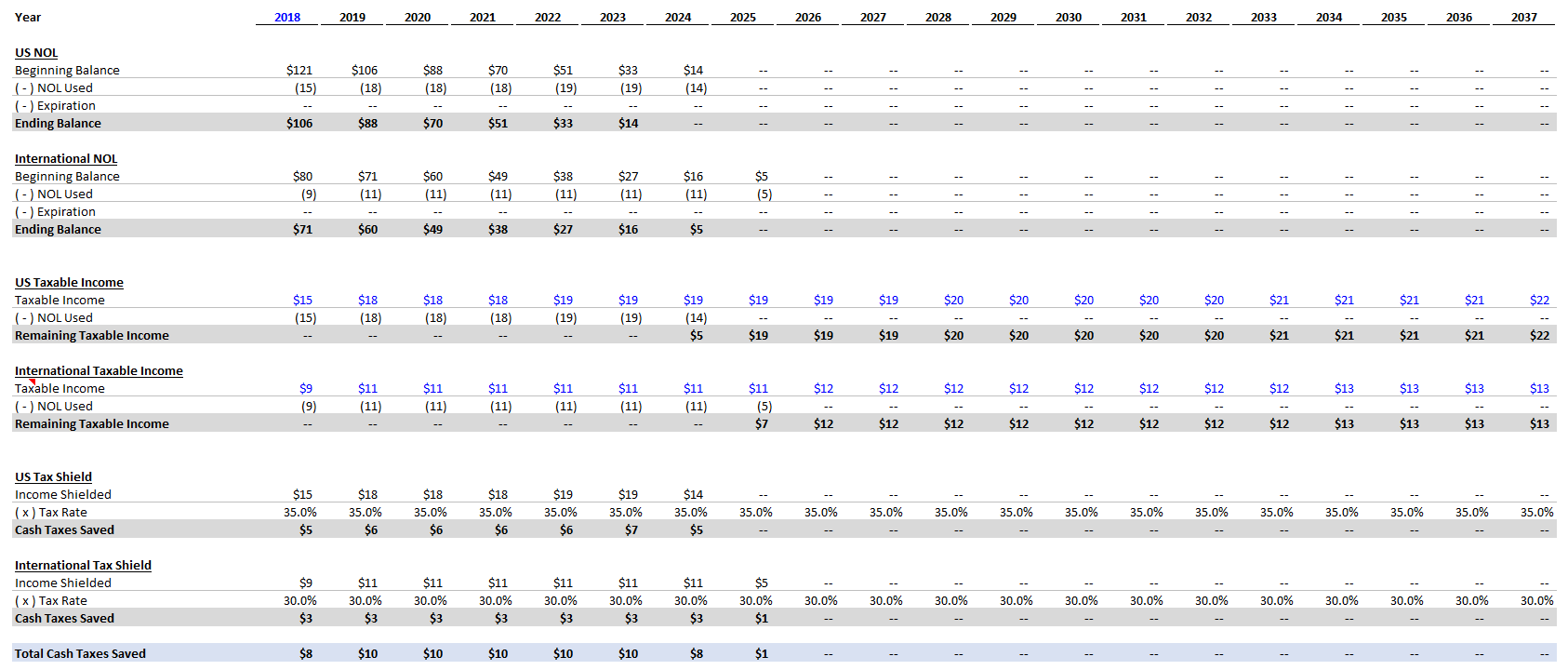

382 b 2 carryforward of unused limitation if the section 382 limitation for any post change year exceeds the taxable income of the new loss corporation for such year which was offset by pre change losses the section 382 limitation for the next post change year shall be increased by the amount of such excess. Under regulations if an ownership change occurs with respect to a corporation the amount of any excess credit for any taxable year which may be used in any post change year shall be limited to an amount determined on the basis of the tax liability which is attributable to so much of the taxable income as does not exceed the section 382 limitation for such post change year to the extent available after the application of section 382 and subsections b and c of this section. Section 382 of the internal revenue code generally requires a corporation to limit the amount of its income in future years that can be offset by historic losses i e net operating loss nol carryforwards and certain built in losses after a corporation has undergone an ownership change.

Section 382 together with section 383 generally affects corporations that undergo a greater than 50 change in ownership during any three year period and that have significant net operating loss. 382 h 3 b ii 382 m and 7805 1 382 2 b 4 and 1 382 7 g of the notice of proposed rulemaking reg 125710 18 published in the federal registeron september 10 2019 84 fr 47455 are withdrawn. In this article we provide an overview of the section 382 limitation and valuation considerations concerning the calculation of the section 382 limitation.

On september 9 2019 the treasury department treasury and the internal revenue service irs proposed regulations proposed regulations addressing items of income and deduction that are included in the calculation of built in gains and losses under section 382 of the internal revenue code. Accordingly under the authority of 26 u s c. Essentially a loss corporation is a firm that can use tax attributes like for instance nol net operating loss.

Under section 382 of the irc a c corporation is required to have a limit to offset historic losses.