Internal Revenue Code Section 163

These questions and answers address the section 163 j limitation after amendment by the tcja.

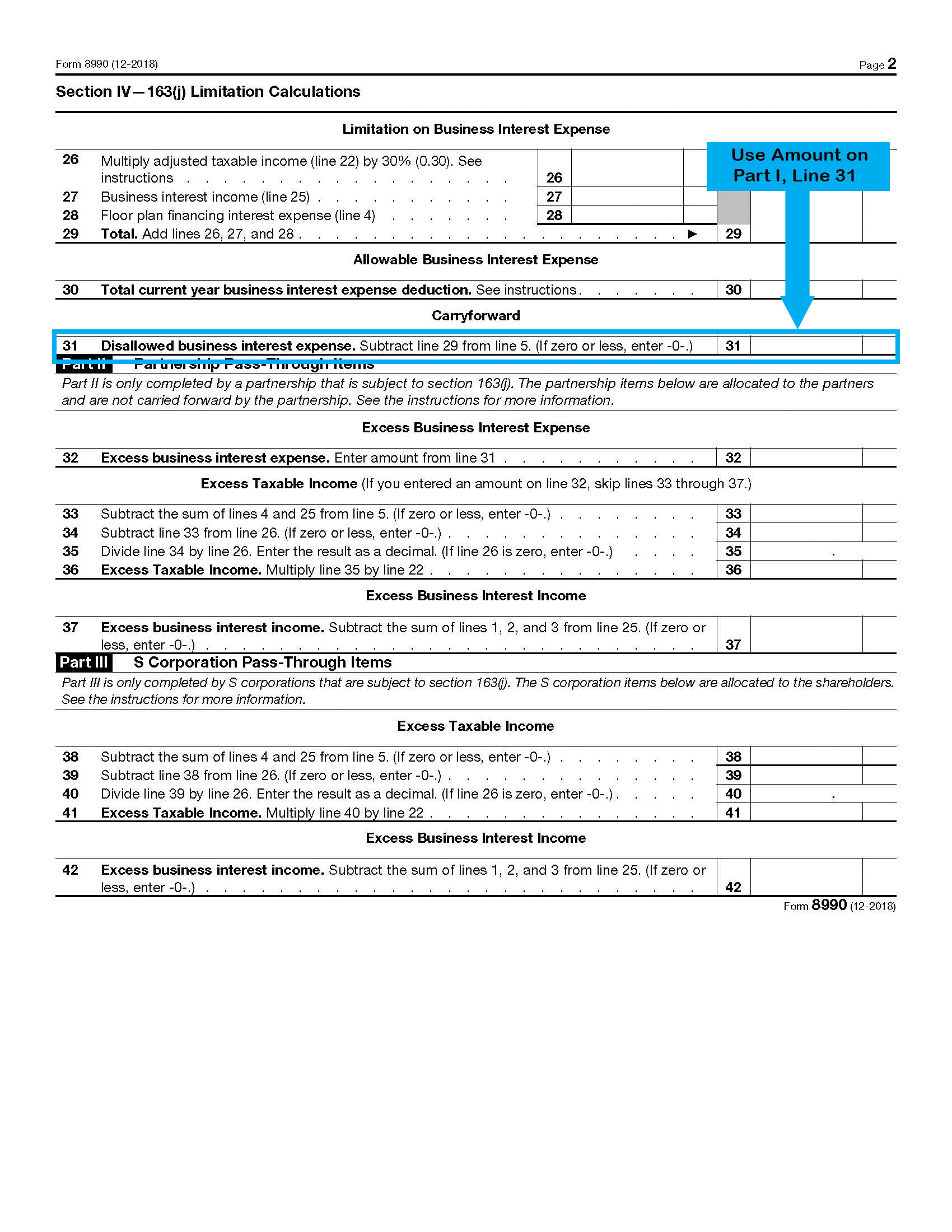

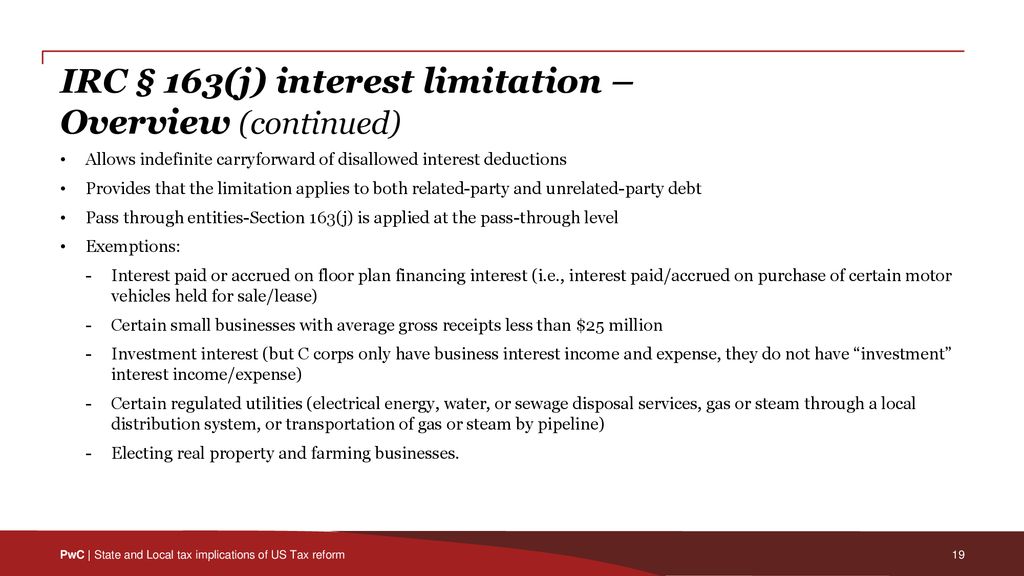

Internal revenue code section 163. The cares act amends irc section 163 j with respect to taxable years beginning in 2019 and 2020. However the tcja significantly changed the section 163 j limitation. 163 e 1 in general the portion of the original issue discount with respect to any debt instrument which is allowable as a deduction to the issuer for any taxable year shall be equal to the aggregate daily portions of the original issue discount for days during such taxable year.

Code unannotated title 26. Internal revenue code 163 26 u s c. Internal revenue code section 163 h 3 e.

The cares act increases the 30 ati threshold to 50 for taxable years beginning in 2019 and 2020. However for individuals 163 h 1 disallows a 2 deduction for personal interest. 163 u s.

1954 as in effect before the enactment of this act oct. Law section 163 a allows as a deduction all interest paid or accrued within the taxable year on indebtedness. In addition the cares act allows taxpayers to elect to use their 2019 ati as their ati in 2020.

In the case of a taxpayer other than a corporation the amount allowed as a deduction under this chapter for investment interest for any taxable year shall not exceed the net investment income of the taxpayer for the taxable year. The amendments made by this section shall not apply but section 163 d of the internal revenue code of 1986 formerly i r c. 4 1976 shall apply.

Internal revenue code section 163 d interest d limitation on investment interest. Internal revenue code 163. For purposes of section 163 h and 1 163 9t disallowance of deduction for personal interest and section 163 d limitation on investment interest any amount allowable as a deduction to a tenant stockholder under section 216 a 2 shall be treated as interest paid or accrued by the tenant stockholder.