Additional Section 263a Costs

So if you don t meet an exception you must look at what costs are required to be capitalized.

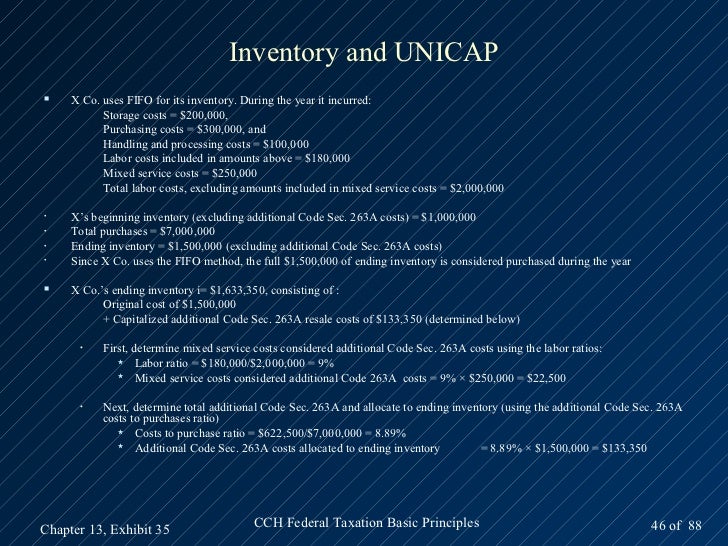

Additional section 263a costs. The allocation used in the regulations prescribed under section 263a h 2 of the internal revenue code of 1986 for apportioning storage costs and related handling costs shall be determined by dividing the amount of such costs by the beginning inventory balances and the purchases during the year and by multiplying the resulting allocation. This residual element is intended to capture the additional sec. The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either resell or produce items that are sold by a business.

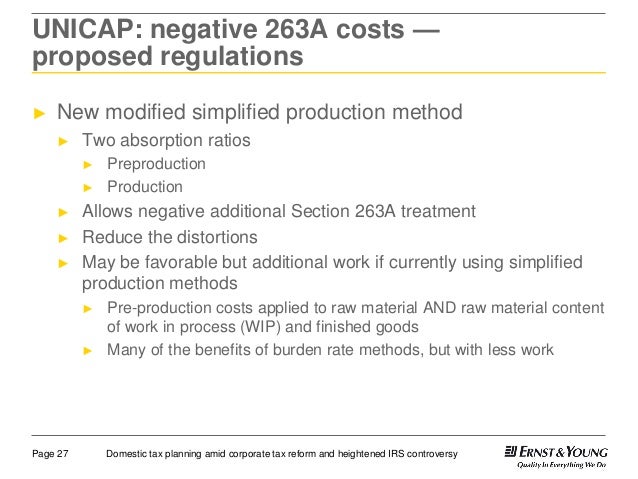

263a costs are the total sec. 263a costs that relate to the direct material on hand at year end. For instance a taxpayer may have negative section 263a costs related to selling and marketing expenses which are generally deductible.

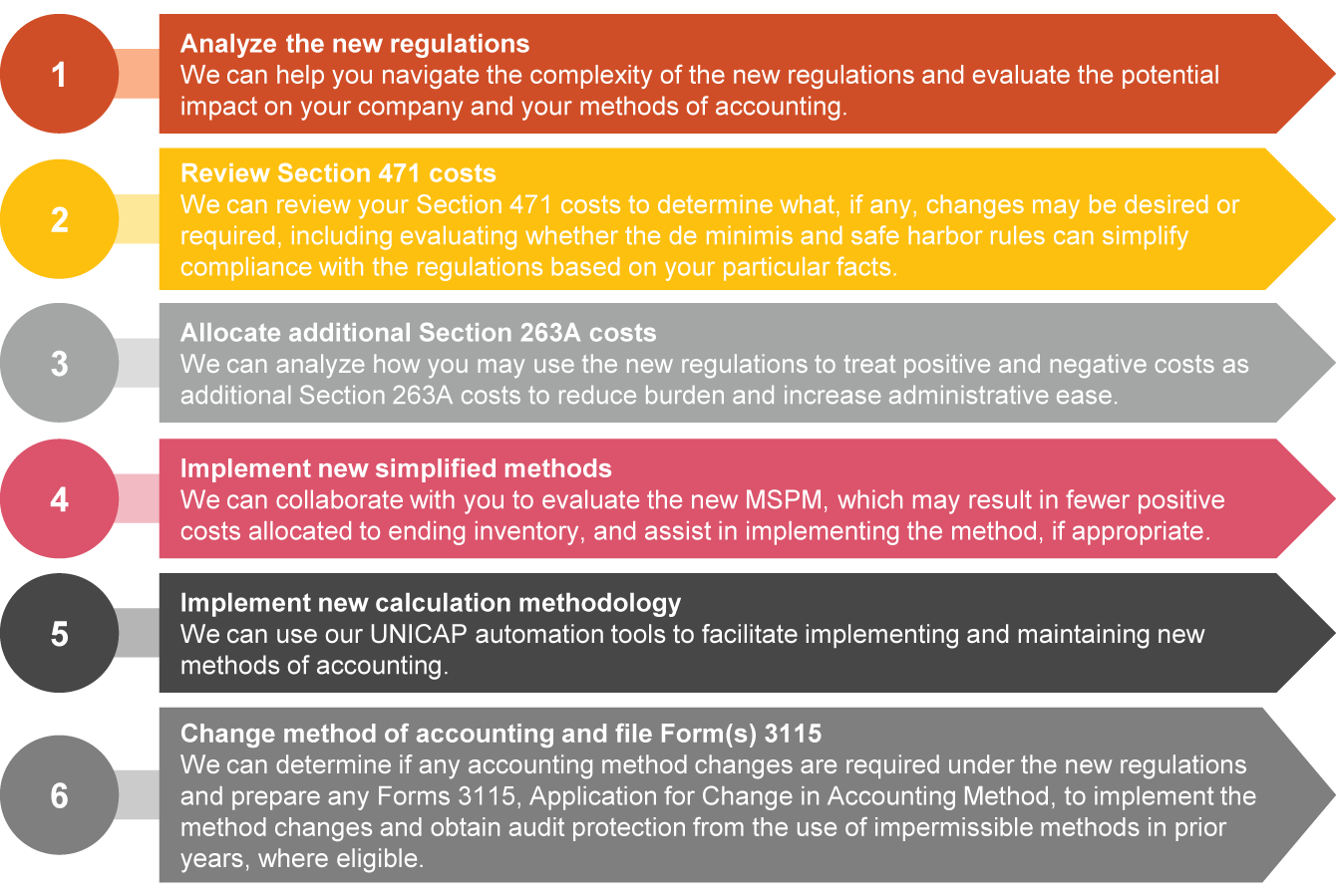

263a costs associated with direct materials in production. It is of interest to note that construction contractors using the percentage of completion method under section 460 the regulations under section 460 mirror the regulations under section 263a. The extensive rules defining section 471 costs and additional section 263a costs in the final regulations result in more complexity in determining whether taxpayers must treat certain costs whether positive or negative as section 471 costs or as additional section 263a costs and when taxpayers may include negative amounts in additional section 263a costs.

Residual pre production additional sec. The final regulations generally apply for tax years beginning on or after november 20 2018. Although most additional section 263a costs are positive negative section 263a costs may arise when a particular cost is capitalized for book purposes but is not required to be capitalized under section 263a.

The total costs allocated to inventory of 220 000 represents our additional section 263a costs for the year and this amount belongs on that line of the cogs schedule in the tax return. Some of these items include processing fees re packing costs assembly costs warehousing fees and payroll for support personnel. Additional section 263a costs generally do not include the direct costs that are required to be included in a taxpayer s section 471 costs under paragraph d 2 ii of this section.

The irs and treasury have published final regulations on the treatment of negative additional section 263a costs which arise when a taxpayer uses a simplified method to allocate costs to ending inventory ei.