What Is A Section 1231 Asset

Property deducted under the de minimis safe harbor for tangible property.

What is a section 1231 asset. 2 non recaptured net section 1231 losses for purposes of this subsection the term non recaptured net section 1231 losses means the excess of. Learn about 1231 1245 1250 property and its treatment for gains and losses. Property for sale to customers.

These losses are applied against your net section 1231 gain beginning with the earliest loss in the 5 year period. Buildings and equipment used in a trade or business and held for more than one year. Section 1231 gains and losses.

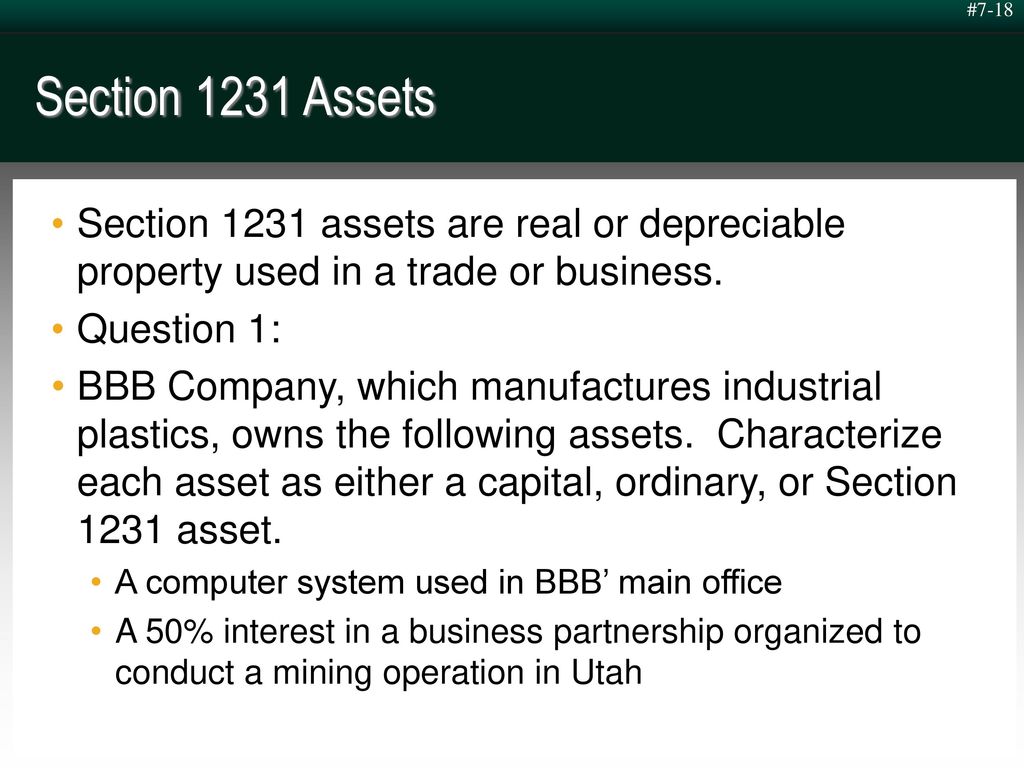

The internal revenue code includes multiple classifications for property. Real or depreciable property. 1231 property includes depreciable property and real property e g.

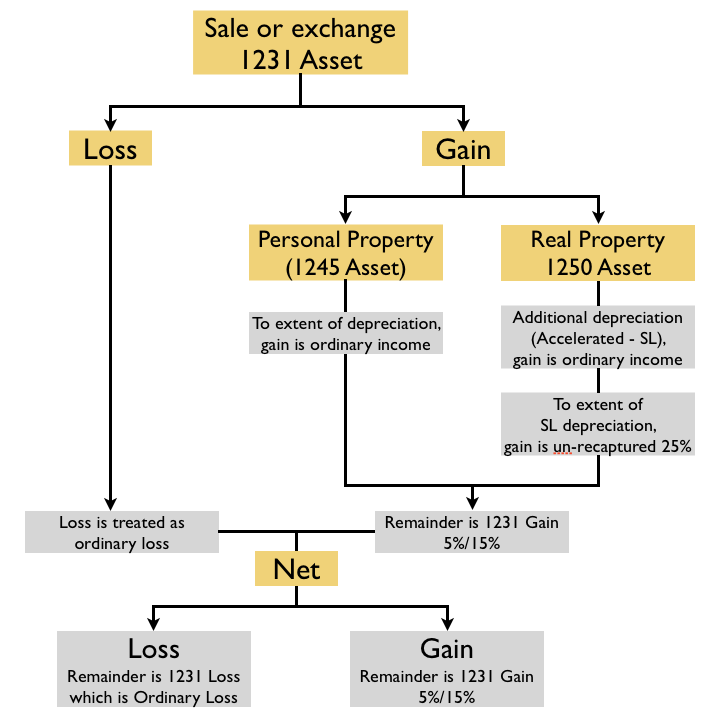

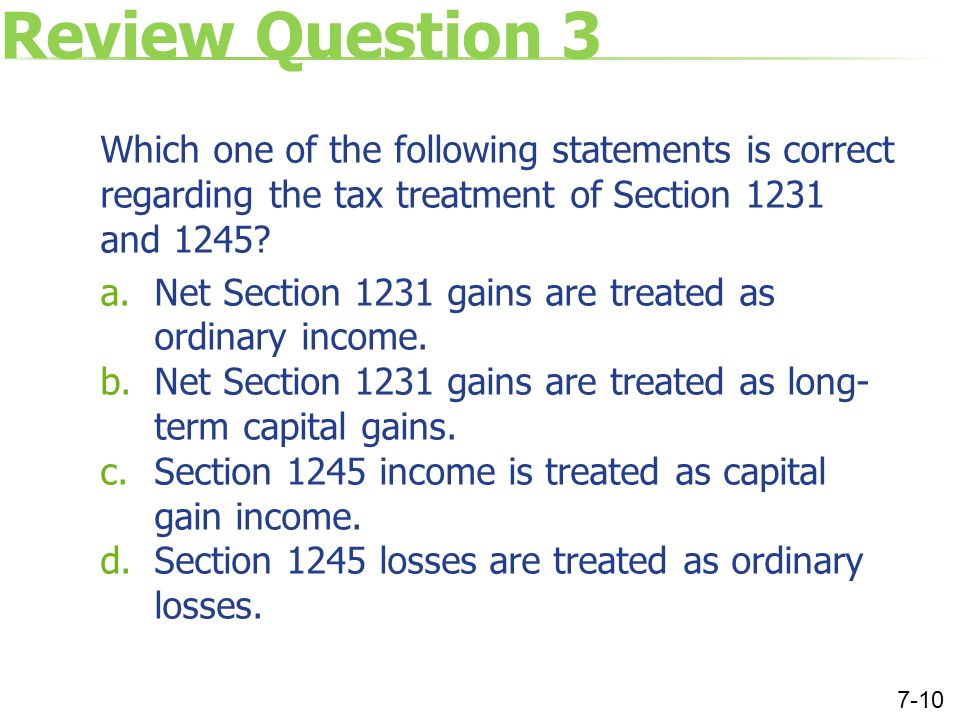

Section 1231 property is real or depreciable business property held for more than one year. An ordinary asset is any asset that is not a capital asset or a business asset. Section 1231 gains and losses are the taxable gains and losses from section 1231 transactions discussed below.

Learn all the details here. Some types of livestock coal timber and domestic iron ore are also included. The holding period starts on the day after you received the property and includes the day you dispose of it.

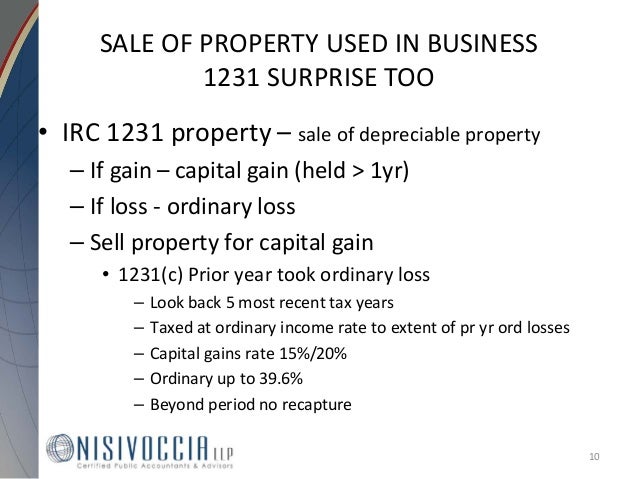

Nonrecaptured section 1231 losses. The net section 1231 gain for any taxable year shall be treated as ordinary income to the extent such gain does not exceed the non recaptured net section 1231 losses. Their treatment as ordinary or capital depends on whether you have a net gain or a net loss from all your section 1231 transactions.

/man-working-in-computer-1135595001-31f457ad7db84839938774cea99939e0.jpg)

:max_bytes(150000):strip_icc()/architecture-building-urban-facade-property-professional-1364228-pxhere.com-cfab579cc3b64694913efdb2ea4d85c0.jpg)