Unrecaptured Section 1250 Gain Tax Rate

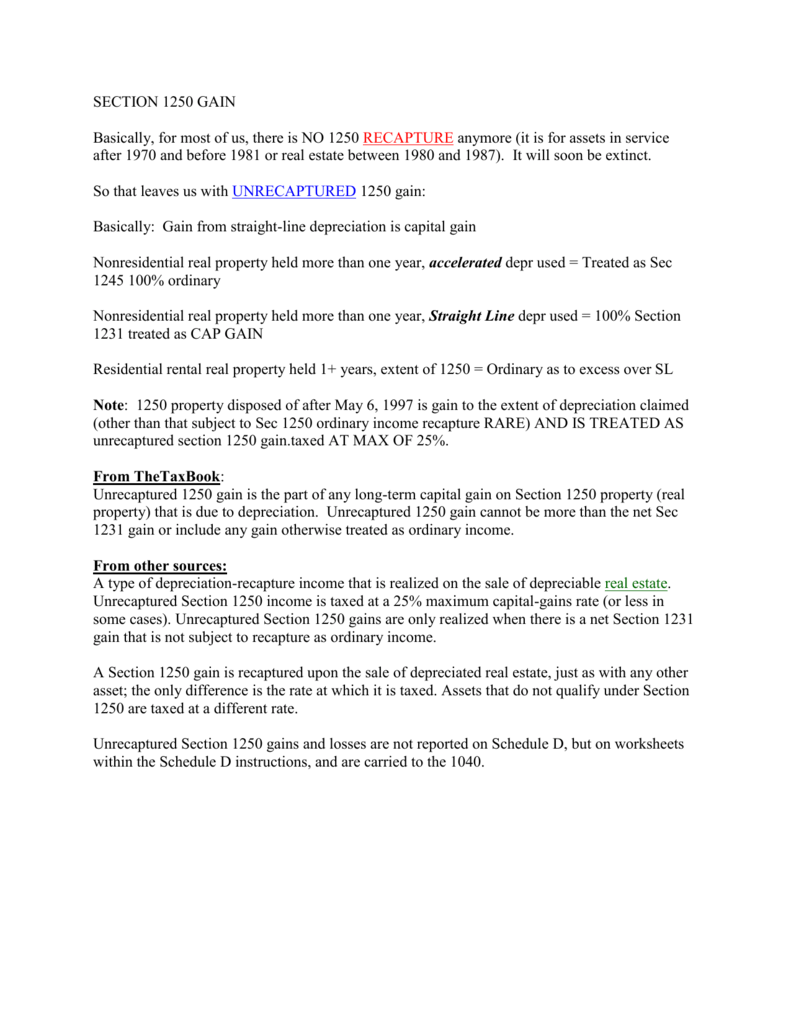

An unrecaptured section 1250 gain is an income tax provision designed to recapture the portion of a gain related to previously used depreciation allowances.

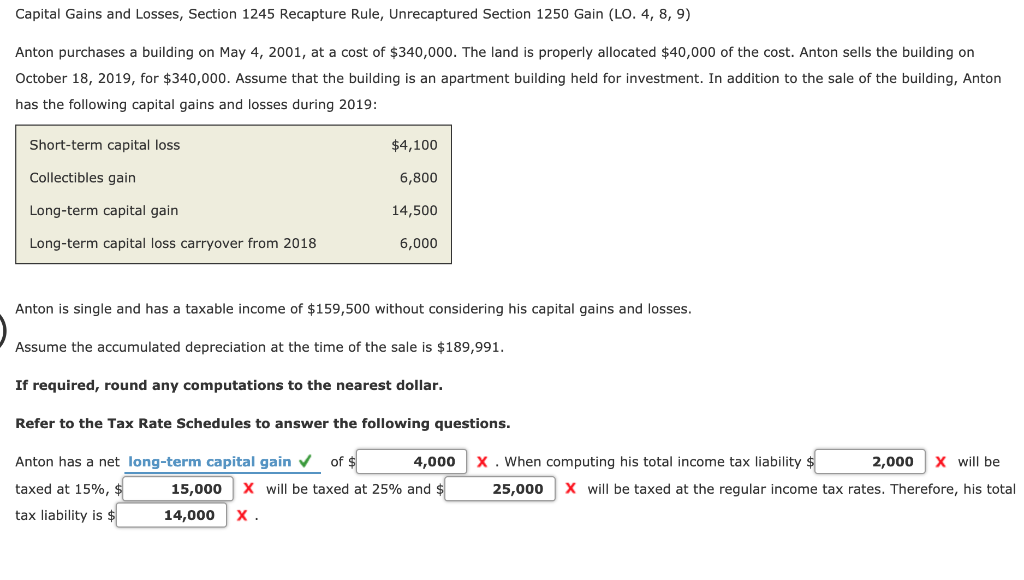

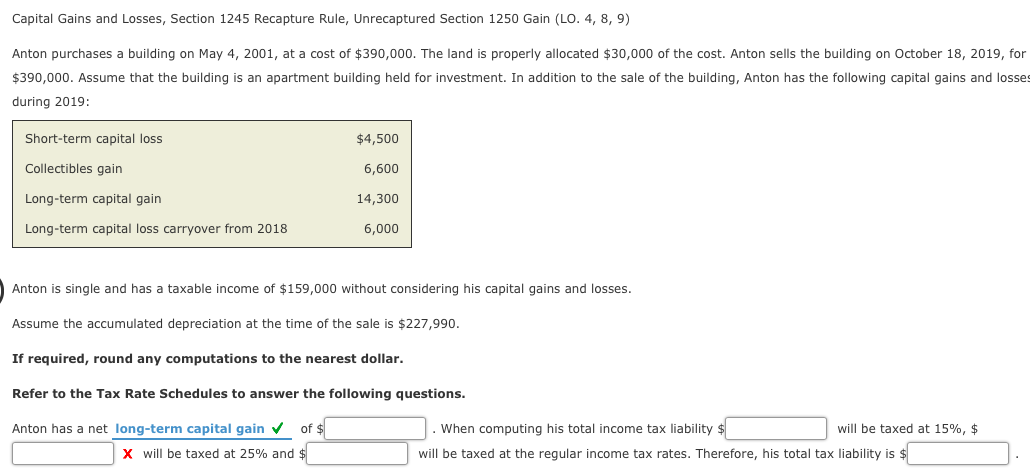

Unrecaptured section 1250 gain tax rate. So you d pay 25 percent on 20 000 of the sale and up. So in my example above the 20 000 of unrecaptured section 1250 gain would be regular tax rates usually 25 and the 50 000 would be taxed at long term capital gain rates usually 15. The gain attributable to the depreciation may be subject to the 25 unrecaptured section 1250 gain tax rate.

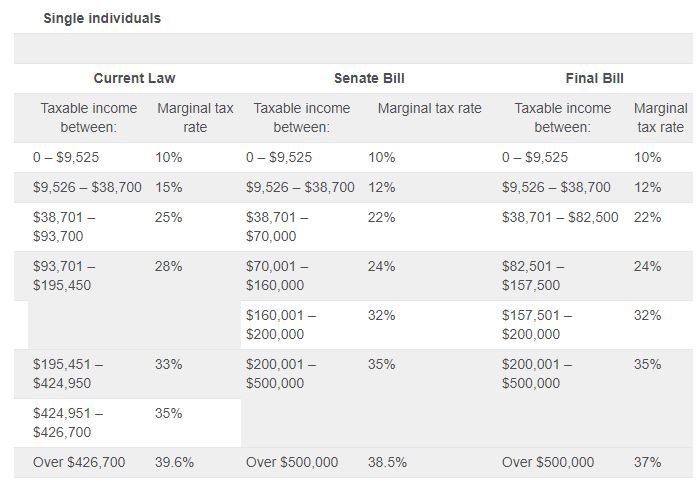

Jack an individual sells nonresidential real property on aug. It is only applicable to the sale of. For 2018 long term capital gains are taxed up to 15 percent for high earners and the unrecaptured section 1250 gain is now a flat 25 percent.

Unrecaptured section 1250 gain is normally taxed at a flat 25 while the long term capital gains tax rate is based on the taxpayer s ordinary taxable income long term capital gains rate single. When coupled with the changes made by the 2003 tax act all depreciation taken can give rise to a higher rate of tax than the newly reduced 15 long term gain rate. The unrecaptured section 1250 gain is taxed at your regular tax bracket up to a maximum of 25.

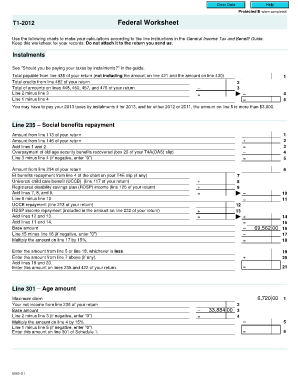

The taxpayer relief act of 1997 imposed a 25 capital gains tax rate for unrecaptured irc section 1250 gains. For more information see questions and answers on the net investment income tax. Refer to publication 523 selling your home and form 4797 sales of business property for specifics on how to calculate and report the amount of gain.

Additionally taxable gain on the sale may be subject to a 3 8 net investment income tax.

/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)