Section 179 Income Limitation

It also increased the phase out threshold from 2 million to 2 5 million.

Section 179 income limitation. The section 179 deduction is use it or lose it for the year of purchase. A taxpayer may elect to expense the cost of any section 179 property and deduct it in the year the property is placed in service. If your business purchases 300 000 worth of equipment in 2020 it cannot write off 250 000 for its 2020 tax year and then 50 000 in the next year.

Business income business loss farm income farm loss. A in general the aggregate cost of section 179 property taken into account under subsection a for any taxable year shall not exceed the aggregate amount of taxable income of the taxpayer for such taxable year which is derived from the active conduct by the taxpayer of any trade or business during such taxable year. The program calculates business income for purposes of the section 179 business income limitation as follows.

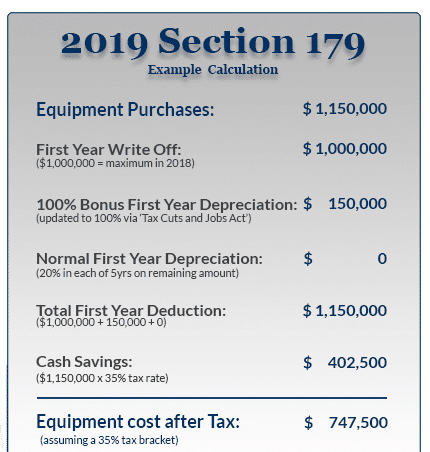

The new law increased the maximum deduction from 500 000 to 1 million. Once this is done if the property you are using for the 170 deduction is over 3 500 000 you cannot take the 179 deduction. You cannot expense more than 25 000 for any suv and certain other vehicles placed in service.

Generally the maximum section 179 expense deduction is 1 020 000 for section 179 property including qualified section 179 real property placed in service during the tax year beginning in 2019. You can use worksheet 1 to assist you in determining the amount to write on line 1. Thus x s section 179 taxable income limitation is 10 900 11 000 less hypothetical 100 section 170 deduction and its section 179 deduction for 1991 is 10 000.

X s taxable income limitation for section 179 purposes is then computed by deducting the hypothetical charitable contribution of 100 for 1991. Wages salaries tips etc. Section 179 does come with limits there are caps to the total amount written off 1 040 000 for 2020 and limits to the total amount of the equipment purchased 2 590 000 in 2020.

The section 179 dollar and investment limitations are applied at the partner and partnership level. If the section 179 business income limitation applies proconnect tax online will generate a section 179 expense limitation worksheet showing the computation.