Section 162 Of The Internal Revenue Code

It concerns deductions for business expenses.

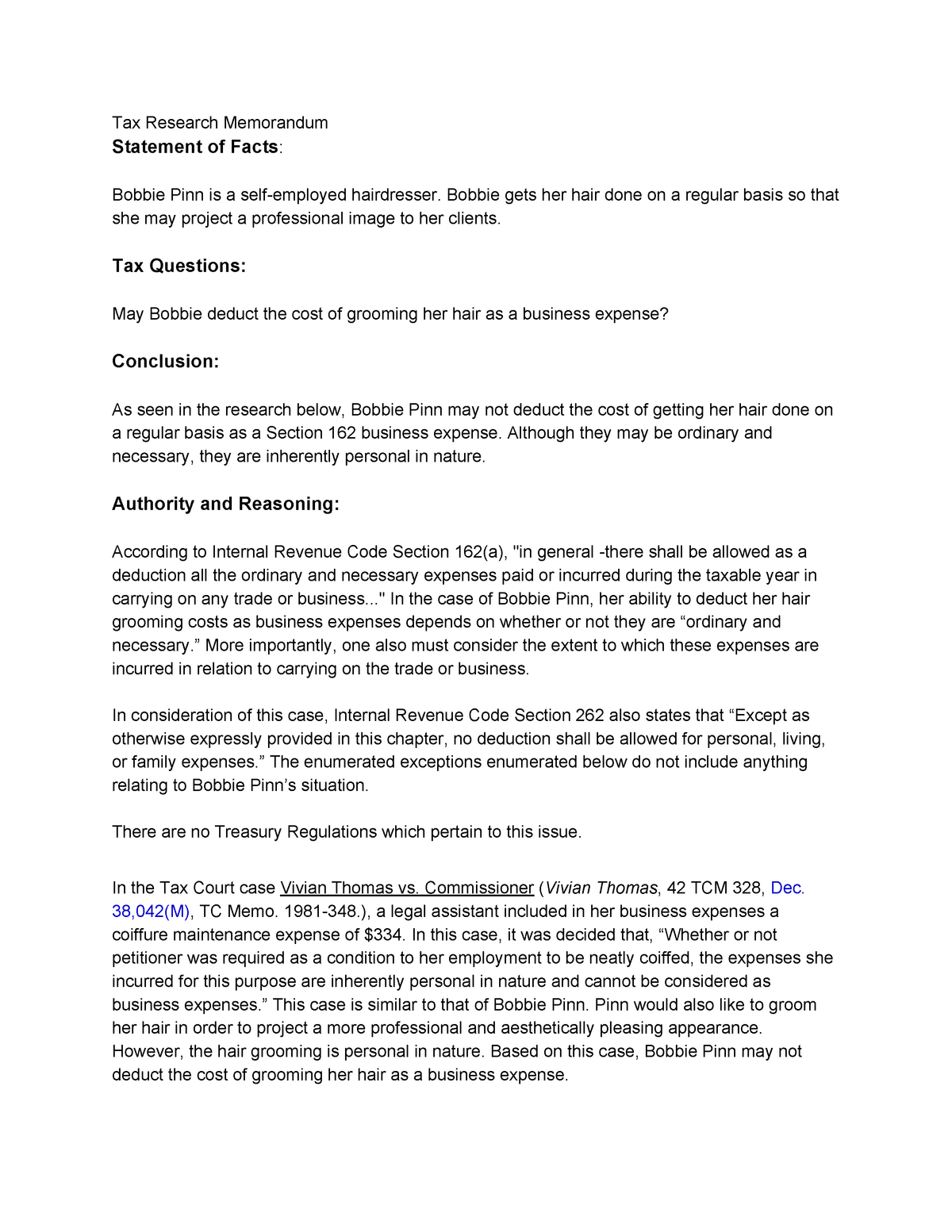

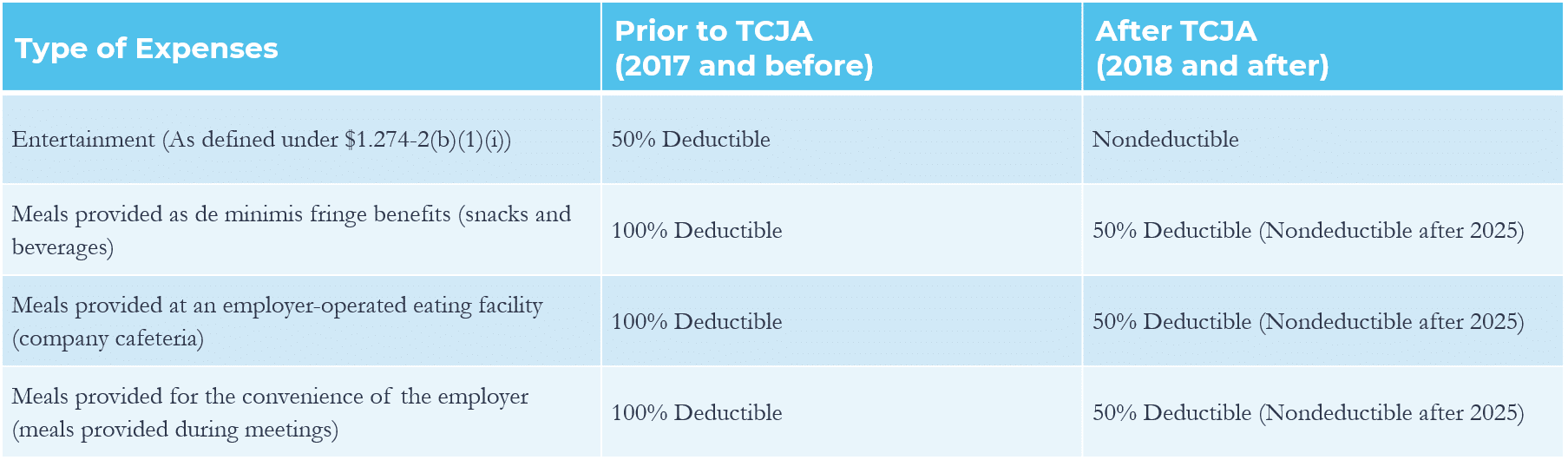

Section 162 of the internal revenue code. For more detailed codes research information including annotations and citations please visit westlaw. Section 262 however provides that no deduction is allowed for personal living or family expenses. Law and analysis section 162 a allows a deduction for all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business.

Internal revenue code section 162 a trade or business expenses a in general. 162 a is part of united states taxation law. Section 162 g of such code as added by subsection a shall apply with respect to amounts paid or incurred after december 31 1969.

Section 162 a of the internal revenue code 26 u s c. Findlaw codes are provided courtesy of thomson reuters westlaw the industry leading online legal research system. It is one of the most important provisions in the code because it is the most widely used authority for deductions.

1954 as added by subsection a shall apply to all taxable years to which such code applies. 162 e 5 d ii any other individual designated by the president as having cabinet level status and. Trade or business expenses on westlaw.

162 e 5 d i any individual serving in a position in level i of the executive schedule under section 5312 of title 5 united states code i r c. Internal revenue code 162.