Section 125 Pre Tax Deductions

Pre tax deductions allow you to take home more of your earnings each pay period.

Section 125 pre tax deductions. In the context of section 125 pre tax means that a deduction is exempt from federal income tax withholding social security and medicare taxes. For amounts incurred or paid after 2017 the 50 limit on deductions for food or beverage expenses also applies to food or beverage expenses excludable from employee income as a. Section 125 is the section of the irs tax code where the items that can be deducted from employee pay on a pre tax basis are defined.

Group insurance premiums can be deducted from your paycheck on a pre tax basis according to irc section 125. 115 97 changed the rules for the deduction of food or beverage expenses that are excludable from employee income as a de minimis fringe benefit. Employees receive benefits as pre tax deductions.

A plan offering only a choice between taxable benefits is not a section 125 plan. If the fsa is the only benefit provided employees may use the account to cover health insurance premiums. Section 125 pre tax premium deductions.

Let s say your gross wages your paycheck before any deductions are made are 750 a week. Section 13304 of p l. The following section 125 cafeteria plan features offer employees significant tax and money saving advantages.

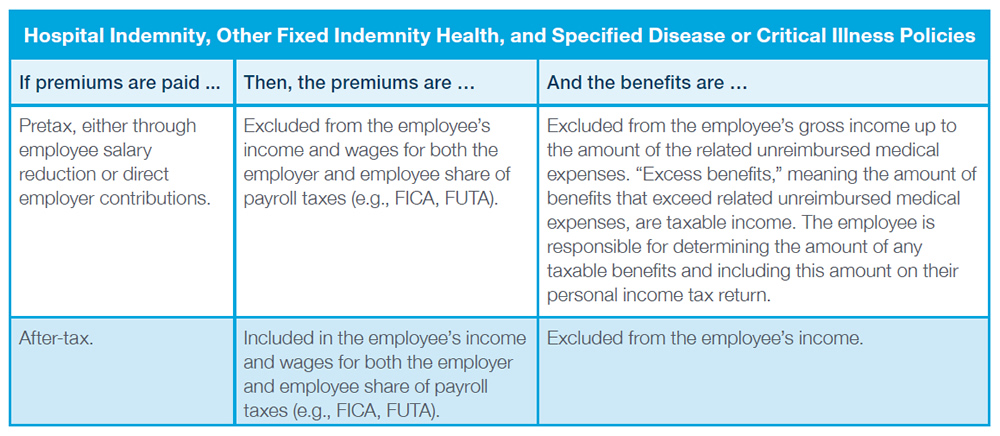

For example if your combined payroll taxes total 22 percent and you allocate 100 of your pre tax pay to a section 125 cafeteria plan you would be able to spend the entire 100 on qualified. In a section 125 plan or cafeteria plan employees can pay qualified medical dental or dependent care expenses on a pretax basis which has the effect of reducing their taxable income as well as their employer s social security fica liability federal income and unemployment taxes and state unemployment taxes where applicable. With pre tax benefits you deduct the employee s contribution before you withhold taxes reducing their taxable income.

Flexible spending accounts fsas. Section 125 is a written plan that lets employees choose between qualifying benefits and cash. A section 125 plan is the only means by which an employer can offer employees a choice between taxable and nontaxable benefits without the choice causing the benefits to become taxable.