Section 125 Deduction Payroll

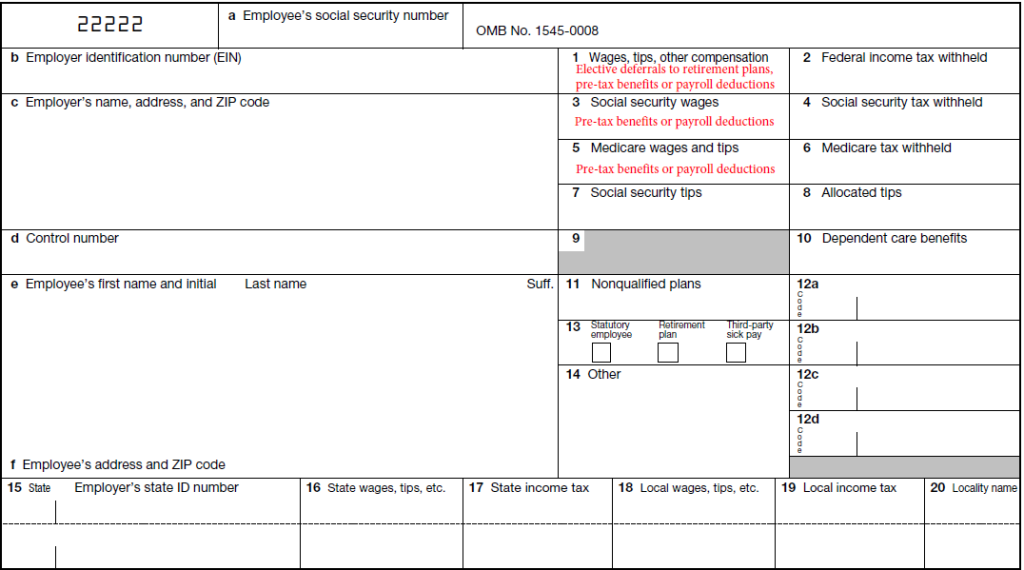

In the context of section 125 pre tax means that a deduction is exempt from federal income tax withholding social security and medicare taxes.

Section 125 deduction payroll. You can save too because eligible businesses do not pay fica matches or futa tax on employee medical deductions. Section 125 deduction codes in payroll 2 19. Enter amount that needs to deducted or added on paycheck for each pay period.

These benefits may be. Under a section 125 benefits plan employers also see a reduction in the amount of income used to determine payroll taxes and experience a reduction in the associated tax liabilities for medicare social security and unemployment. Section 125 plans from paychex can save money for your company and employees a section 125 premium only plan pop and flexible spending account fsa also known as cafeteria plans can reduce fica federal and state and local taxes for your company and employees when combined with your company s group health insurance.

Section 125 is the section of the irs tax code where the items that can be deducted from employee pay on a pre tax basis are defined. We re trying to figure out what the the tax rules for the section 125 deduction codes mean 805154 section 125 code dd ee deduction 805158 section 125 ee deduction. Section 125 is a written plan that lets employees choose between qualifying benefits and cash.

Because the money deducted from workers pay isn t subject to taxes federal state local medicare or social security employees retain a greater portion of their earnings. Also in most states employees can save the state income tax on these deductions. In the additions deductions and company contributions section.

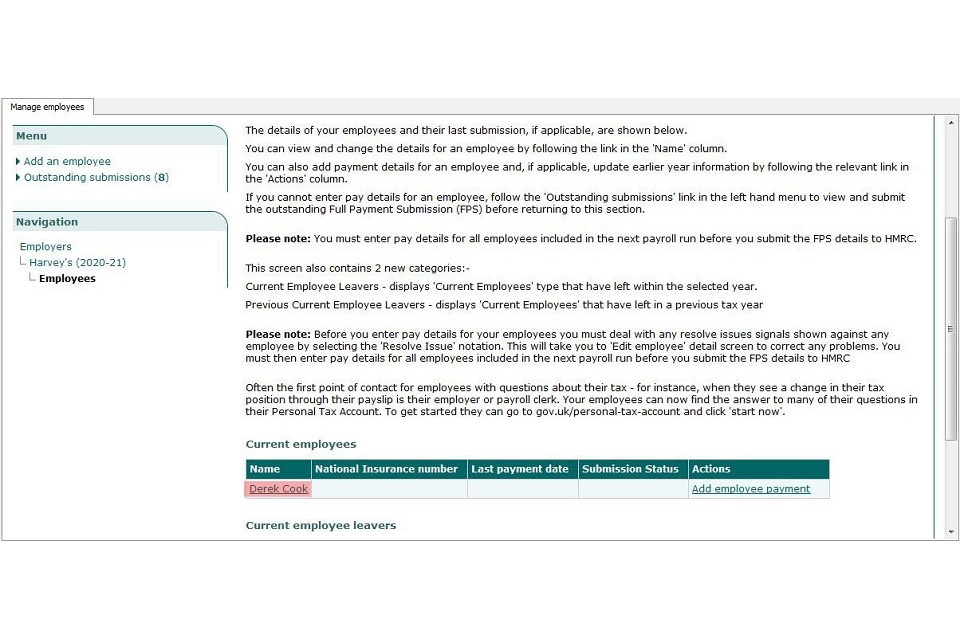

Employees receive benefits as pre tax deductions. Select the new payroll item s for the section 125 plan. How do you start a section 125 plan.

Select the payroll info tab. Select under item name to bring up drop down list. For example if your combined payroll taxes total 22 percent and you allocate 100 of your pre tax pay to a section 125 cafeteria plan you would be able to spend the entire 100 on qualified.