Section 1244 Small Business Stock

Select start or revisit by stocks mutual funds bonds other.

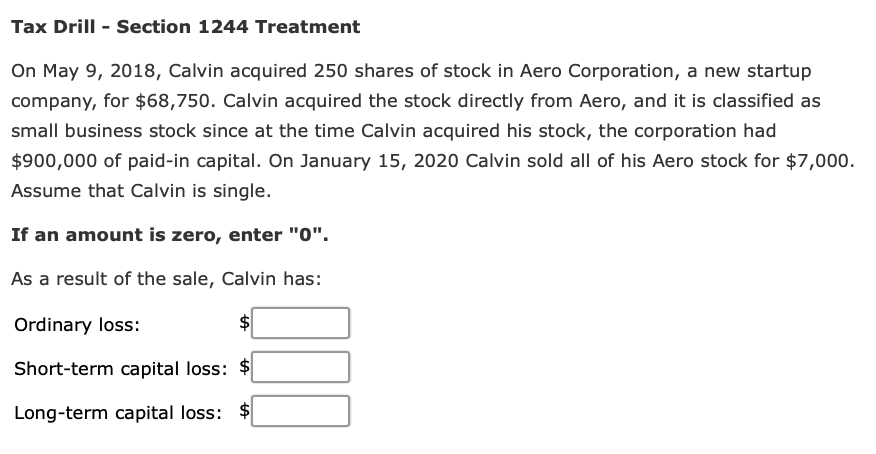

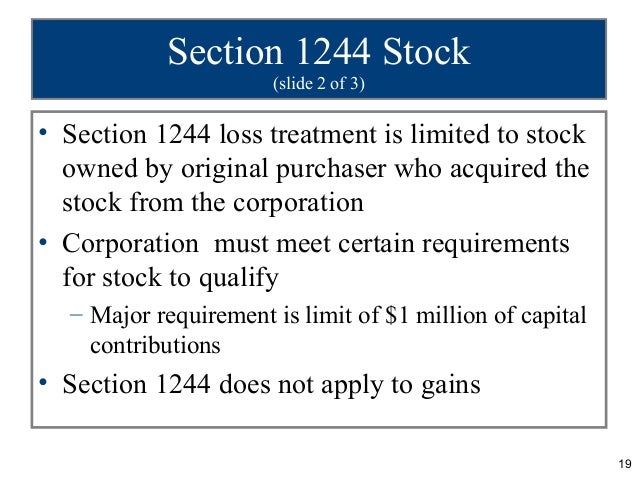

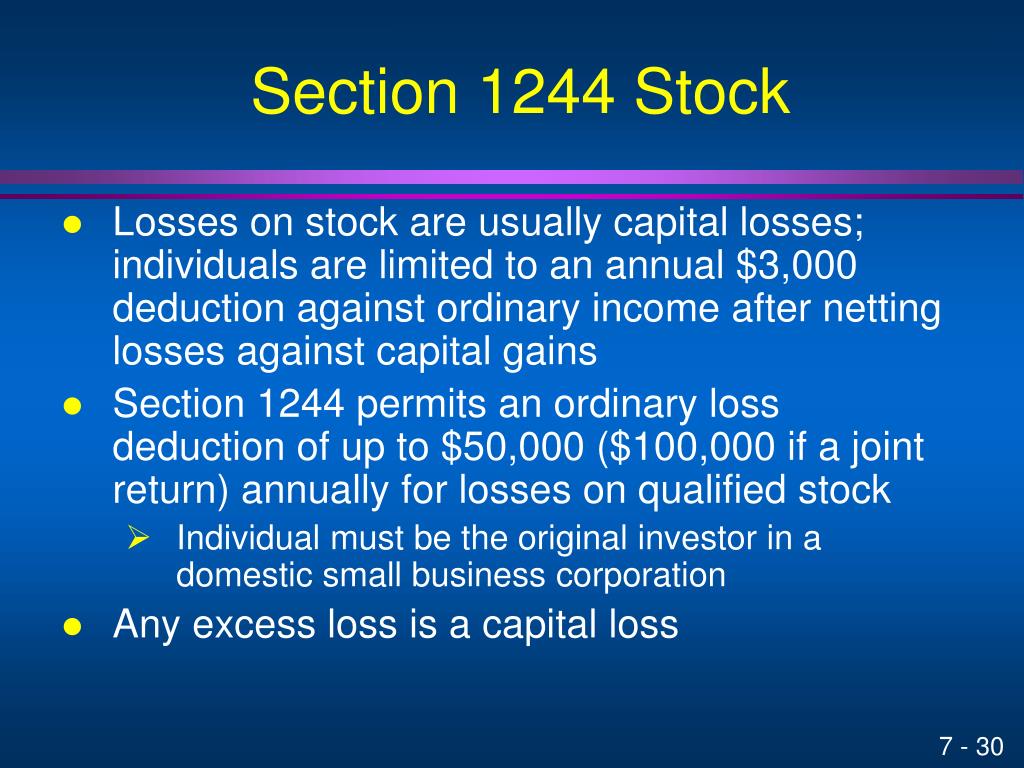

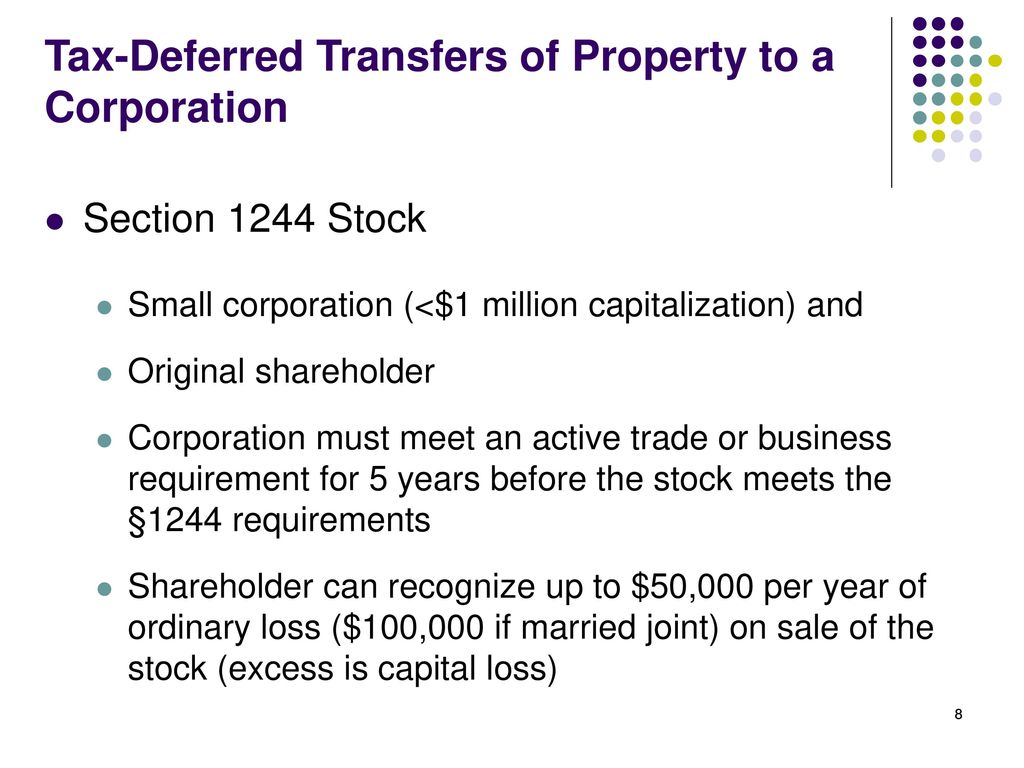

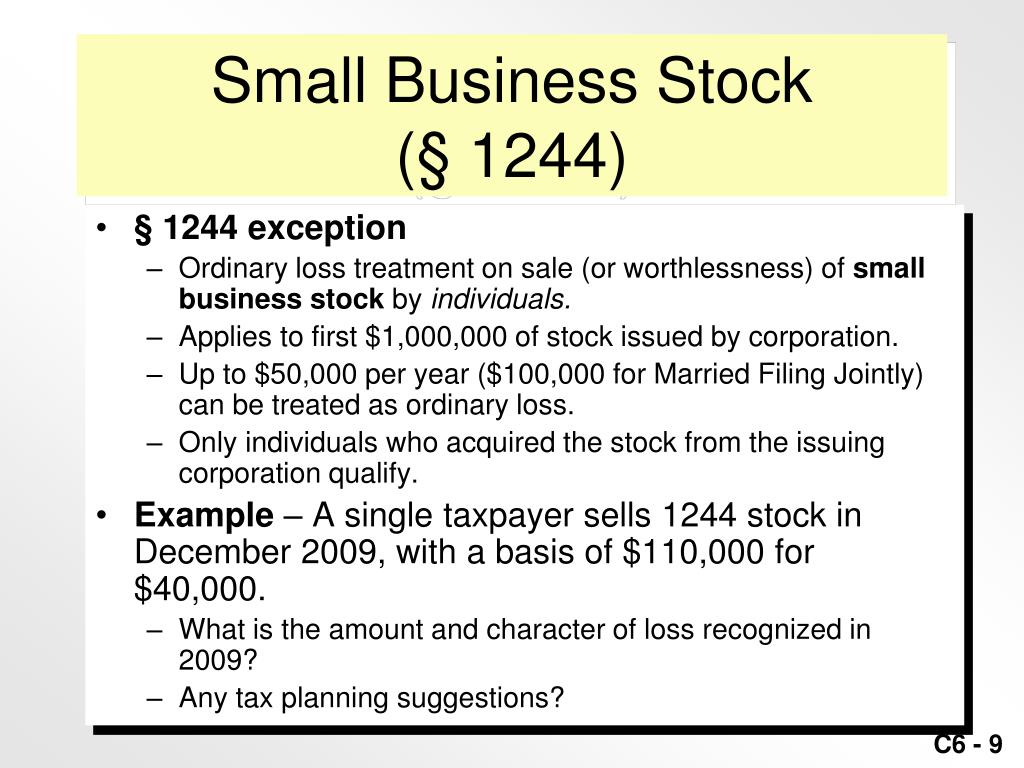

Section 1244 small business stock. You can deduct as an ordinary loss rather than as a capital. 1 in generalfor purposes of this section the term section 1244 stock means stock in a domestic corporation. 1244 encourages new investment in small business by permitting investors to claim an ordinary rather than a capital loss on the disposition including worthlessness of qualifying small business stock.

Section 1244 stock encourages new investment in small business by permitting investors to claim ordinary losses on risky investments. By peter jason riley 1 the corporation issuing the stock must qualify as a domestic small business corporation which generally means that. C section 1244 stock defined 1 in general for purposes of this section the term section 1244 stock means stock in a domestic corporation if a.

3 section 1244 is available. Startups and small businesses are risky endeavors. Section 1244 of the internal revenue code is the small business stock provision enacted to allow shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than as a capital loss which is limited to only 3 000 annually.

Qualifying for section 1244 stock. From here your screens may be different if you have already entered information into this section. In order to qualify as 1244.

2 common stock and preferred stock issued after july 18 1984 qualifies as 1244 stock. Corporations and can be either a common or preferred. Losses on section 1244 small business stock.

Exclusion of section. What is a section 1244 stock. Publication 550 investment income and expenses capital gains and losses losses on section 1244 small business stock.

/stock-exchange-graph-and-numbers-926129268-c3014a39c2b74eadb53015d9f45d67f9.jpg)