Section 1231 Exchange

Property deducted under the de minimis safe harbor for tangible property.

Section 1231 exchange. The term which gets its name from irs code section 1031 is. The term section 1231 loss means any recognized loss from a sale or exchange or conversion described in subparagraph a. 4 special rulesfor purposes of this subsection a in determining under this subsection whether gains exceed losses.

Section 1231 gains and losses. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. If you will get back all or nearly all of your investment in the property by selling it rather than by using it up in your business it is property held mainly for sale to customers.

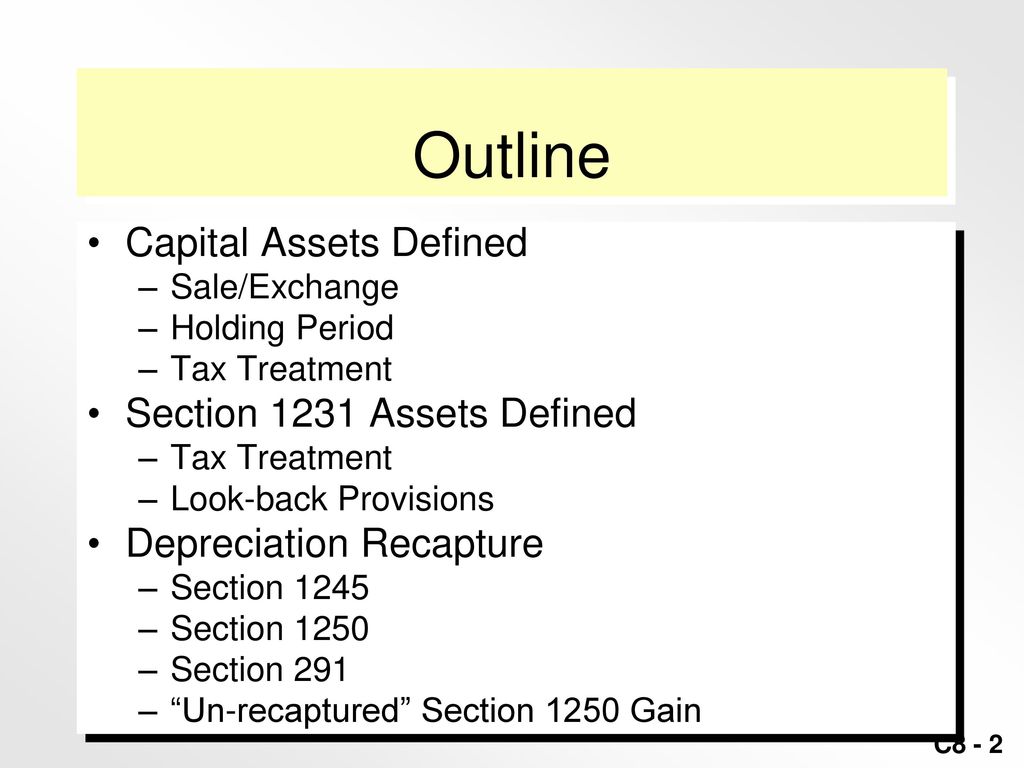

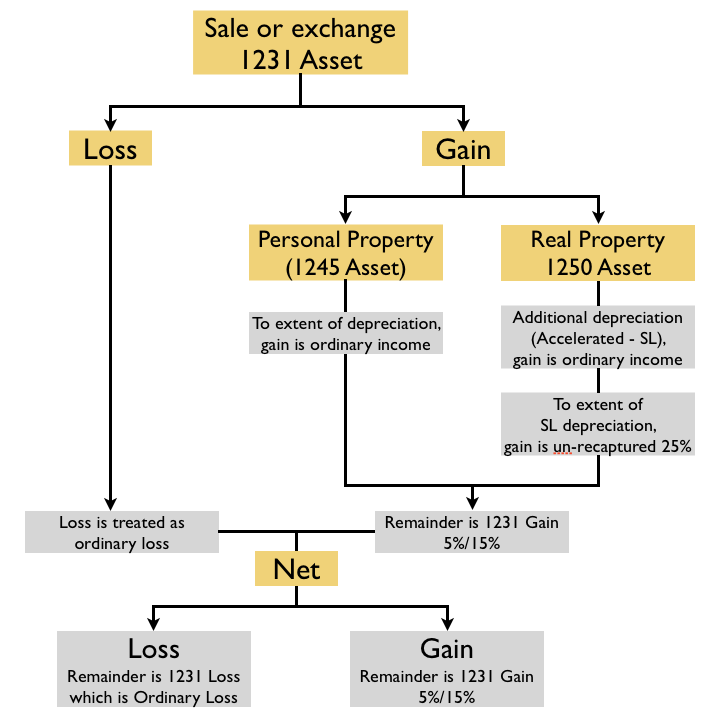

Section 1231 is the section of the internal revenue code that governs the tax treatment of gains and losses on the sale or exchange of real or depreciable property used in a trade or business and held over one year. Whether you sell one piece of section 1231 property or your entire business section 1231 rules apply. Like kind exchanges when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or like kind have long been permitted under the internal revenue code.

The present version of the internal revenue code has retained section 1231 with the provision now applying to both property lost in an involuntary conversion and to the sale or exchange of certain kinds of business use property. The term 1031 exchange is defined under section 1031 of the irs code. 1 to put it simply this strategy allows an investor to defer paying capital gains taxes on an investment property when it is sold as long another like kind property is purchased with the profit gained by the sale of the first property.

Section 1231 property is real or depreciable business property held for more than one year. Nonrecaptured section 1231 losses. Section 1231 property is a type of property defined by section 1231 of the u s.

Treatment as ordinary or capital. Section 1231 does not apply to a sale exchange or involuntary conversion of an unharvested crop if the taxpayer retains any right or option to reacquire the land the crop is on directly or indirectly other than a right customarily incident to a mortgage or other security transaction. Generally if you make a like kind exchange you are not required to recognize a gain or loss under internal revenue code section 1031.

/man-working-in-computer-1135595001-31f457ad7db84839938774cea99939e0.jpg)

/GettyImages-929595526-69ab1adce68740c3882d60964c12bea9.jpg)