Section 1231 Assets Definition

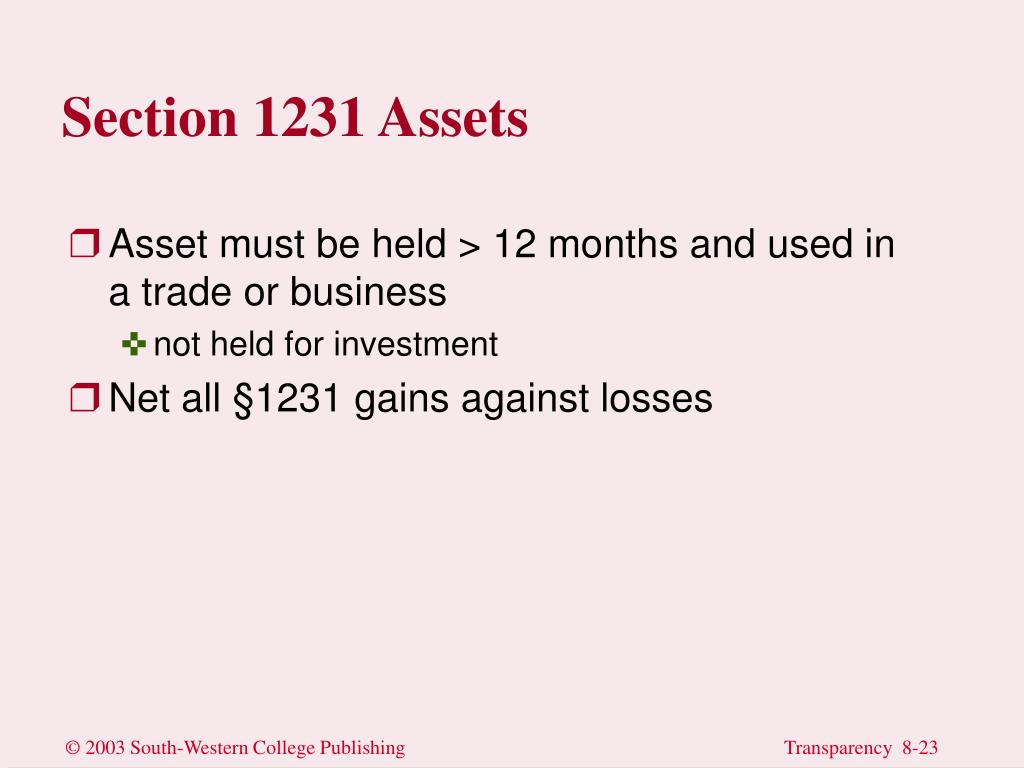

Buildings and equipment used in a trade or business and held for more than one year.

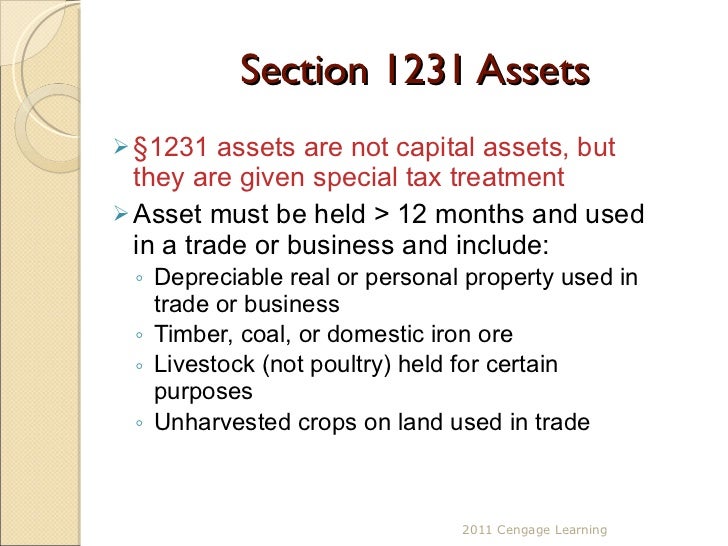

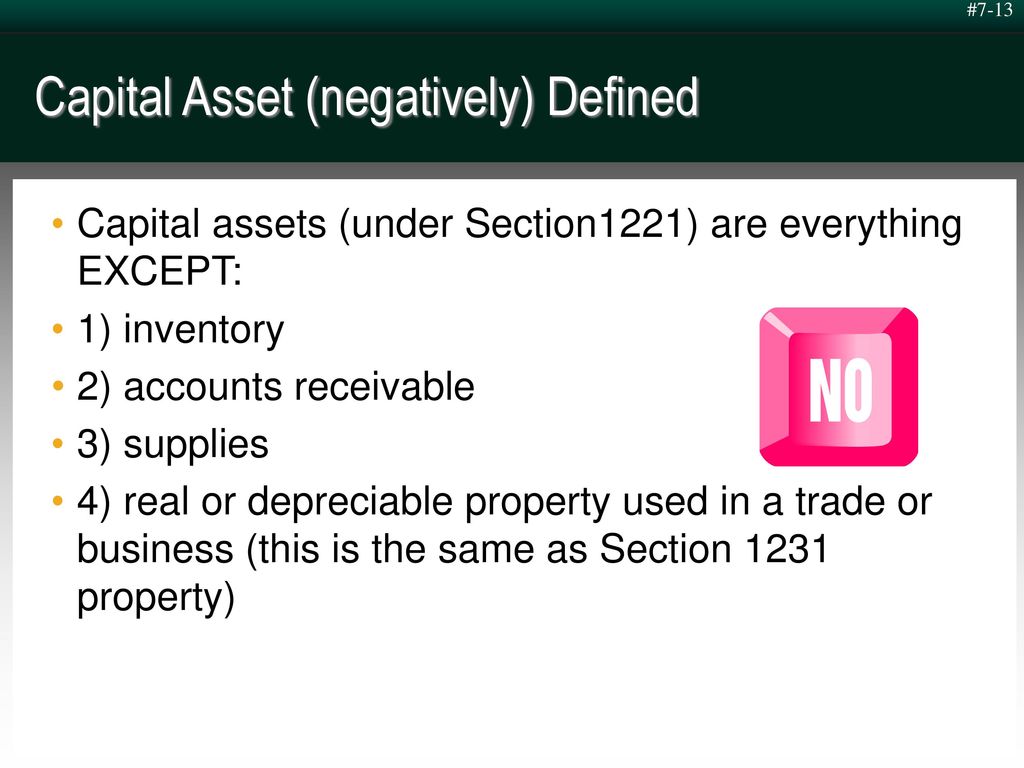

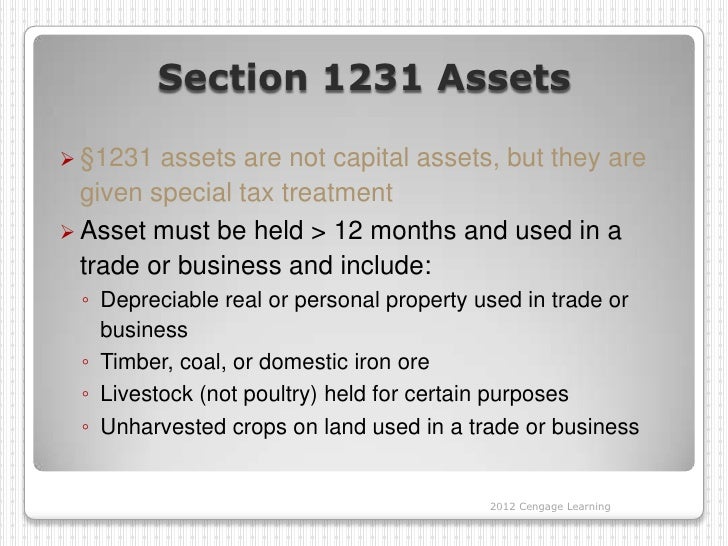

Section 1231 assets definition. Section 1231 property is real or depreciable business property held for more than one year. This property must be used in a trade or business and held longer than 1 year. Some types of livestock coal timber and domestic iron ore are also included.

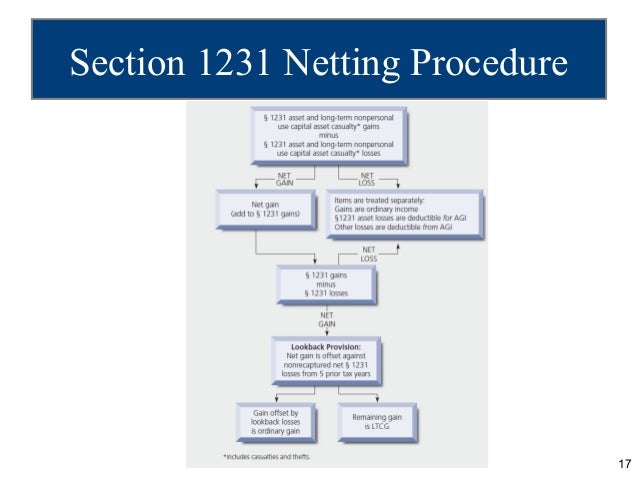

2 non recaptured net section 1231 losses for purposes of this subsection the term non recaptured net section 1231 losses means the excess of. Learn about 1231 1245 1250 property and its treatment for gains and losses. The net section 1231 gain for any taxable year shall be treated as ordinary income to the extent such gain does not exceed the non recaptured net section 1231 losses.

Is used for trade or business. Has been held for at least one year. Gain or loss on the business or rental part of the property may be a capital gain or loss or an ordinary gain or loss as discussed in chapter 3 under section 1231 gains and losses.

Section 1231 property is a type of property defined by section 1231 of the u s. Generally property held for the production of rents or royalties is considered to be used in a trade or business. Property used in a trade or business the internal revenue code includes multiple classifications for property.

1231 property is a category of property defined in section 1231 of the u s. 1231 property includes depreciable property and real property e g. Section 1231 property includes depreciable assets and real estate used in a trade or business and held for more than one year.

Under certain circumstances it also includes timber coal domestic iron ore livestock held for draft breeding dairy or sporting purposes and unharvested crops. You cannot deduct a loss on the personal part.