Section 105 Medical Reimbursement Plan Irs

A section 105 plan is an irs regulated health benefit that allows the tax free reimbursement of medical and insurance expenses as described under section 105 of the internal revenue code irc.

Section 105 medical reimbursement plan irs. An example of a section 105 plan is a health reimbursement account hra. The code allows business owners and their employees to pay for medical expenses and reimbursements using pre tax dollars if a qualified section 105 plan is adopted. Plan for employees are treated as amounts received through accident or health insurance for purposes of 105.

Under section 105 a amounts received by an employee through a self insured medical reimbursement plan which are attributable to contributions of the employer or are paid by the employer are included in the employee s gross income unless such amounts are excludable under section 105 b. Section 105 plans are used by employers in a variety of ways. Section 1 105 5 a of the income tax regulations provides that an accident or health plan is an arrangement for the payment of amounts to employees in the event of personal injuries or sickness.

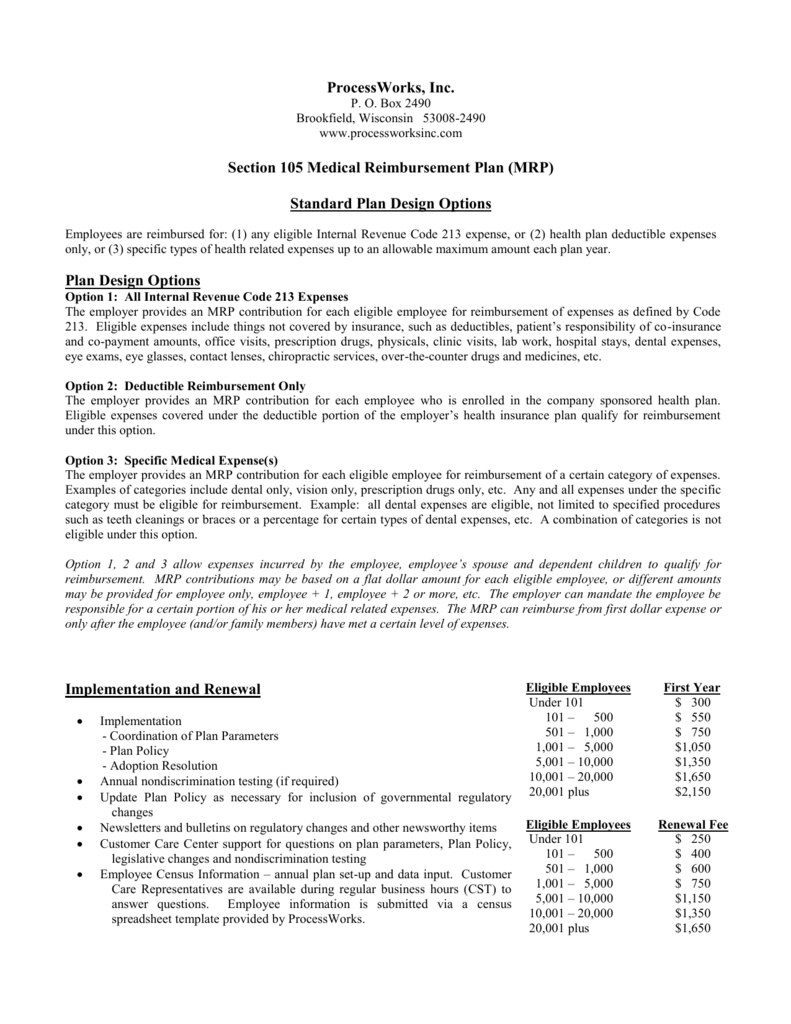

Current qualified section 105 plans include self insured plans group integrated hra health reimbursement arrangement and stand alone reimbursement medical plans such as the qsehra qualified small employer health reimbursement arrangement or a one person hra. On september 30 2019 the irs and the department of the treasury issued proposed regulations clarifying the application of the employer shared responsibility provisions in code section 4980h and the nondiscrimination rules in code section 105 h to individual coverage hras and providing proposed safe harbors for the application of those provisions to individual coverage hras with certain changes compared to the potential safe harbors described in notice 2018 88. Rather than purchasing group coverage that your qualifying employees can opt into you allow them to find their own coverage and then reimburse them for qualified expenses.

Section 105 sets the following requirements for an eligible plan. Irs section 105 addresses the exclusion of reimbursements provided by an accident or health plan for the medical expenses of an individual or their dependents from the individual s gross taxable income. Employers are the sole contributors to the plan.

Section 213 d 1 defines medical care to include amounts paid for the diagnosis cure mitigation treatment or prevention of disease or for the.