Irs Section 125 Regulations

It provides participants an opportunity to receive certain benefits on a pretax basis.

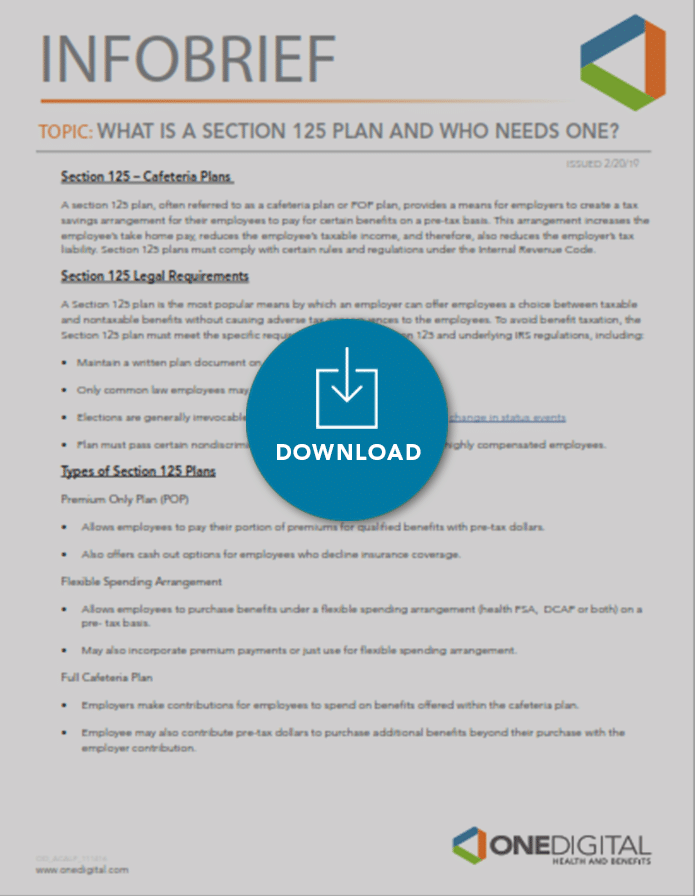

Irs section 125 regulations. The below listed items describe the essential original requirements. A cafeteria plan is a separate written plan maintained by an employer for employees that meets the specific requirements of and regulations of section 125 of the internal revenue code. In addition to participating in the promulgation of treasury tax regulations the irs publishes a regular series of other forms of official tax guidance including revenue rulings revenue procedures notices and announcements see understanding irs guidance a brief primer for more information about official irs guidance versus non precedential rulings or advice.

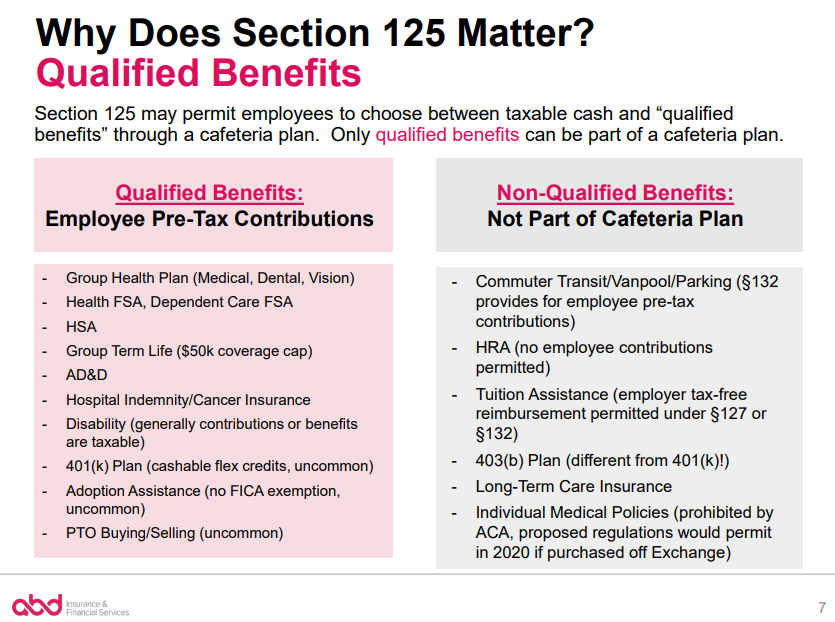

8 qualified benefits plan. A general transitional rule any cafeteria plan in existence on february 10 1984 which failed as of such date and continued to fail thereafter to satisfy the rules relating to section 125 under proposed treasury regulations and any benefit offered under such a cafeteria plan which failed as of such date and continued to fail thereafter to satisfy the rules of section 105 106 120. There are many advantages of setting up a premium only plan for employees.

The notice provides temporary flexibility for section 125 cafeteria plans to permit employees to make some changes to employer sponsored health coverage health fsas and dependent care assistance. Irs code section 125 allows an employer to set up a premium only plan pop where an employee s insurance premium contributions can be deducted from his or her payroll on a pre tax basis. The prohibition against long term care insurance and long term care services section 125 f and the addition of the key employee concentration test in section 125 b 2.

Internal revenue service irs notice 2020 29 provides for increased flexibility with respect to mid year elections under a section 125 cafeteria plan during calendar year 2020 due. Section 125 plans must be tested annually to ensure compliance with irs regulations. A qualified benefits plan means an employee benefit plan governing the provision of one or more benefits that are qualified benefits under section 125 f.

The cafeteria plan had minimum formality and requirements but had a wide range of potential options. Generally the third party administrator tpa of the section 125 plan will send these tests to employers to complete. The prior proposed regulations 1 125 1 and 1 125 2 provide the basic framework and requirements for cafeteria plans and elections under cafeteria plans.

The irs code defined a section 125 plan.