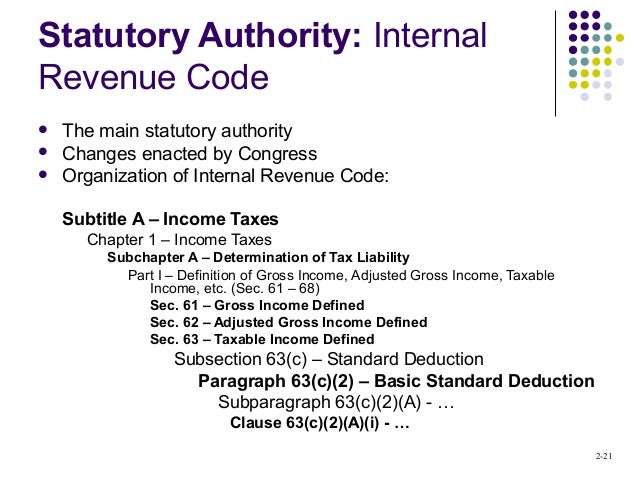

Internal Revenue Code Section 62

The deductions allowed by this chapter other than by part vii of this subchapter which are attributable to a trade or business carried on by the taxpayer if such trade or business does not consist of the performance of.

Internal revenue code section 62. 95 615 2 nov. 21 attorneys fees relating to awards to whistleblowers any deduction allowable under this chapter for attorney fees and court costs paid by or on behalf of the taxpayer in connection with any award under section 7623 b relating to awards to whistleblowers. 31 1976 and before apr.

For more detailed codes research information including annotations and citations please visit westlaw. 62 a 2 a reimbursed expenses of employees the deductions allowed by part vi section 161 and following which consist of expenses paid or incurred by the taxpayer in connection with the performance by him of services as an employee under a reimbursement or other expense allowance arrangement with his employer. 8 1978 92 stat.

For purposes of this subtitle the term adjusted gross income means in the case of an individual gross income minus the following deductions. Section 62 a 2 a of the code and 1 62 2 b of the income tax regulations provide that for purposes of determining adjusted gross income an employee may deduct certain business expenses paid by the employee in connection with the performance of services as an employee under a reimbursement or other expense allowance arrangement with his employer. Internal revenue code section 62 a 20 adjusted gross income defined.

3097 provided that with respect to transportation costs paid or incurred after dec. 1 trade and business deductions. Subsection a of section 62 relating to general rule defining adjusted gross income is amended by inserting after paragraph 20 the following new paragraph.