Internal Revenue Code Section 482

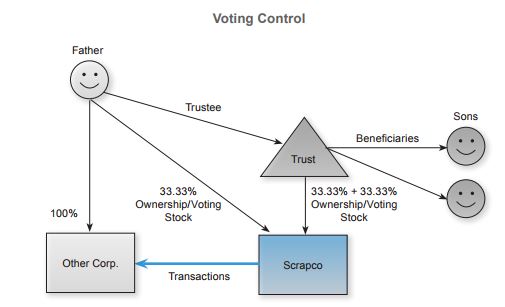

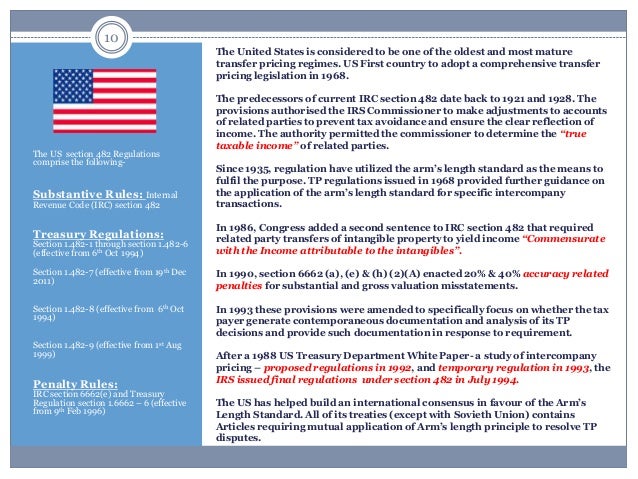

The purpose of section 482 is to ensure that taxpayers clearly reflect income attributable to controlled transactions and to prevent the avoidance of taxes with respect to such transactions.

Internal revenue code section 482. Internal revenue code 482. In any case of two or more organizations trades or businesses whether or not incorporated whether or not organized in the united states and whether or not affiliated owned or controlled directly or indirectly by the same interests the secretary may distribute apportion or allocate gross income deductions credits or allowances between or among such organizations trades or. Source credit amendments effective date regulations savings provision miscellaneous 482.

The study shall include a review of the contemporaneous documentation and penalty rules under section 6662 of the internal revenue code of 1986 a review of the regulatory and administrative guidance implementing the principles of section 482 of such code to transactions involving intangible property and services and to cost sharing arrangements and an examination of whether increased disclosure of cross border transactions should be required. For more detailed codes research information including annotations and citations please visit westlaw. Allocation of income and deductions among taxpayers.

Section 482 places a controlled taxpayer on a tax parity with an uncontrolled taxpayer by determining the true taxable income of the controlled taxpayer. From title 26 internal revenue code subtitle a income taxes chapter 1 normal taxes and surtaxes subchapter e accounting periods and methods of accounting part iii adjustments jump to.